Advance Auto Parts 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

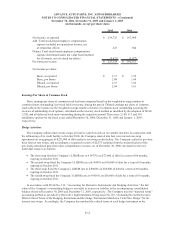

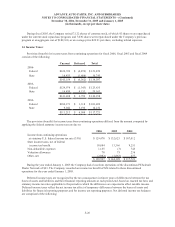

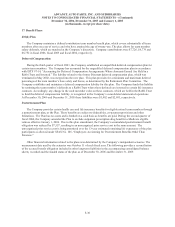

11. Other Long-term Liabilities:

Other long-term liabilities consist of the following:

December 30, December 31,

2006 2005

Employee benefits 10,330$ 17,253$

Deferred income taxes 26,048 36,958

Other 24,856 20,663

Total other long-term liabilities 61,234$ 74,874$

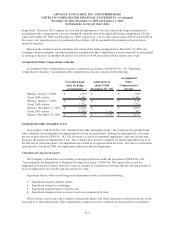

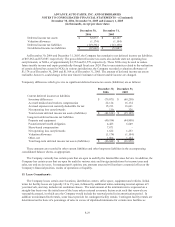

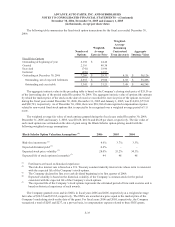

12. Long-term Debt:

Long-term debt consists of the following:

December 30,

2006

December 31,

2005

Senior Debt:

Tranche A, Senior Secured Term Loan at variable interest

rates (5.66% at December 31, 2005), redeemed October 2006 -$ 170,000$

Tranche B, Senior Secured Term Loan at variable interest

rates (5.89% at December 31, 2005), redeemed October 2006 - 168,300

Delayed Draw, Senior Secured Term Loan at variable interest

rates (5.91% at December 31, 2005), redeemed October 2006 - 100,000

Revolving facility at variable interest rates

(6.13% and 5.66% at December 30, 2006 and December 31, 2005,

respectively) due October 2011 476,800 -

Other 440 500

477,240 438,800

Less: Current portion of long-term debt (67) (32,760)

Long-term debt, excluding current portio

n

477,173$ 406,040$

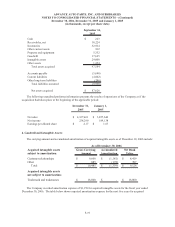

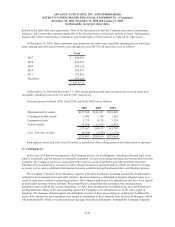

On October 5, 2006, the Company entered into a new $750,000 unsecured five-year revolving credit facility

with Advance Stores Company, Incorporated, a subsidiary of the Company, serving as the borrower. This new

facility replaced the Company’s term loans and revolver under the previous credit facility. Proceeds from this

revolving loan were used to repay $433,775 of principal outstanding on the Company’s term loans and

revolver under its previous credit facility. In conjunction with this refinancing, the Company wrote-off existing

deferred financing costs related to the Company’s previous term loans and revolver. The write-off of these costs of

$1,887 was combined with a related gain on settlement of interest rate swaps of $2,873 for a net gain on

extinguishment of debt of $986.

Additionally, the new revolving credit facility provides for the issuance of letters of credit with a sub limit of

$300,000 and swingline loans in an amount not to exceed $50,000. The Company may request that the total

revolving commitment be increased by an amount not exceeding $250,000 during the term of the credit agreement.

Voluntary prepayments and voluntary reductions of the revolving balance are permitted in whole or in part, at the

Company’s option, in minimum principal amounts as specified in the new revolving credit facility.

As of December 30, 2006, the Company had borrowed $476,800 under the revolver and had $66,768 in letters

of credit outstanding, which reduced availability under the new revolver to $206,432. In addition to the letters of

credit, the Company maintains approximately $2,527 in surety bonds issued by its insurance provider primarily to

utility providers and the departments of revenue for certain states. These letters of credit and surety bonds generally

have a term of one year or less.

F-24