Advance Auto Parts 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

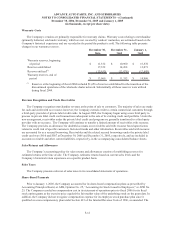

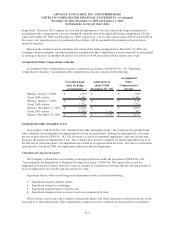

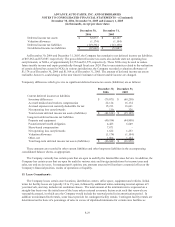

December 31,

2005

Estimated fixed costs 15,351$

Insurance recovery of fixed costs, net of deductibles (6,518)

Insurance recovery for merchandise inventories settled

during the year, net of deductibles (8,941)

Net expense (108)$

(a)

(a) Does not include the earnings impact of sales disruptions.

During the year ended December 30, 2006, the Company lost one store location due to fire and received

additional recoveries as the Company settled additional hurricane claims for damaged inventory at retail value and

for damaged capital assets at replacement value. Accordingly, earnings for the year ended December 30, 2006

reflected $1,388 of insurance recoveries, net of deductibles.

The Company expects to recognize additional recoveries in future quarters primarily representing the remaining

retail value of damaged merchandise and the replacement value of damaged capital assets not previously settled.

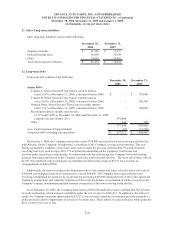

6. Discontinued Operations:

In fiscal 2003, the Company discontinued the supply of merchandise to its Wholesale Distribution Network, or

Wholesale. Wholesale consisted of independently owned and operated dealer locations, for which the Company

supplied merchandise inventory. This component of the Company’s business operated in the Company’s previously

reported wholesale segment. For the fiscal year ended January 1, 2005, the operating results related to the

discontinued wholesale business were minimal as a result of recognizing an estimate of exit costs in fiscal 2003.

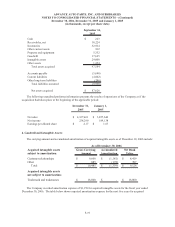

7. Receivables:

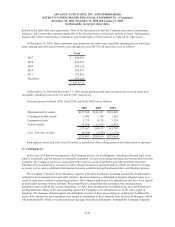

Receivables consist of the following:

December 30, December 31,

2006 2005

Trade 13,149$ 13,733$

Vendor 73,724 63,161

Installment 2,336 5,622

Insurance recovery 9,676 13,629

Other 2,801 3,230

Total receivables 101,686 99,375

Less: Allowance for doubtful accounts (4,640) (4,686)

Receivables, ne

t

97,046$ 94,689$

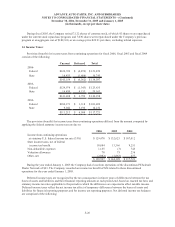

In August 2005, the Company began using a new third party provider to process its private label credit card

transactions related to its commercial business. In conjunction with this transition, the Company sold the credit card

portfolio for proceeds totaling $33,904. Accordingly, the Company’s previously recorded receivable balance

recognized under SFAS No. 140, “Accounting for Transfers and Servicing of Financial Assets”, of $34,684 and the

corresponding allowance for doubtful accounts of $2,580 were reduced to zero. Additionally, the Company repaid its

borrowings previously secured by these trade receivables; the overall impact was a benefit of $1,800 recorded as a

reduction of bad debt expense in selling, general and administrative expenses.

F-21