Advance Auto Parts 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.xWe completed the refinancing of our previous secured credit facility to an unsecured revolving credit

facility; and

xOn February 15, 2006, our Board of Directors declared a quarterly cash dividend, the first in our history.

Refinancing

On October 5, 2006, we entered into a new $750 million unsecured five-year revolving credit facility. This new

facility replaced the term loans and revolver under our previous secured credit facility. Initial proceeds from this

revolving loan were used to repay $434 million of principal outstanding on the term loans and revolver under our

previous credit facility. As a result of the improved borrowing costs under the new facility, we anticipate pre-tax

interest expense savings of more than $2.5 million annually. In conjunction with this refinancing, we wrote-off

existing deferred financing costs related to our previous term loans and revolver. The write-off of these costs of

$1.9 million was combined with a related gain on settlement of interest rate swaps of $2.9 million for a net gain on

extinguishment of debt of $1.0 million.

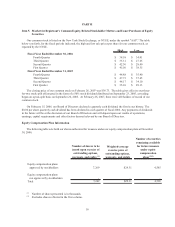

Stock Repurchase Program

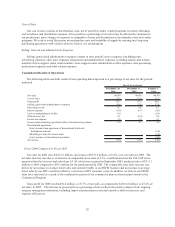

During fiscal 2006, we repurchased 3.7 million shares of common stock at an aggregate cost of $136.6 million,

or an average price of $37.12 per share, excluding related expenses. Our stock repurchase program, as authorized by

our Board of Directors in fiscal 2005, authorizes us to repurchase up to $300 million of our common stock plus

related expenses. The program allows us to repurchase our common stock on the open market or in privately

negotiated transactions from time to time in accordance with the requirements of the Securities and Exchange

Commission. As of December 30, 2006, we had $104.0 million, excluding related expenses, remaining for future

stock repurchases under the stock repurchase program.

Commercial Program

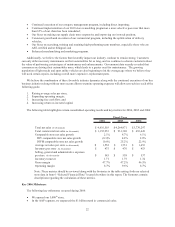

As indicated in the preceding operating results table, our commercial program produced solid revenues in our

AAP stores during fiscal 2006. We attribute this performance to the execution of our commercial plan, which

consists of:

xTargeting commercial customers with a hard parts focus;

xTargeting commercial customers who need access to a wide selection of inventory;

xMoving inventory closer to our commercial customers to ensure quicker deliveries;

xGrowing our market share of the commercial market through internal growth and selected acquisitions;

xProviding trained parts experts to assist commercial customers’ merchandise selections;

xShifting commercial delivery vehicles or other commercial resources to store locations where they can be

most productive; and

xProviding credit solutions to our commercial customers through our commercial credit program.

Commercial sales represented approximately 25% of our consolidated total sales for the fiscal year compared to

almost 22% in fiscal 2005, including AI. At December 30, 2006, we operated commercial programs in 82% of our

stores, including the 87 AI stores, up from approximately 78% at the end of the prior fiscal year. We continued to

approach our goal of operating commercial programs in approximately 85% of our AAP store base. Due to AI’s sole

focus on the commercial business, virtually all of their sales are to commercial customers.

We believe we have the opportunity to grow our commercial business for the foreseeable future through the

continued execution of our commercial plan and growth in our commercial programs. We believe the acquisition of

AI supplements our commercial growth due to AI’s established delivery programs and knowledge of the commercial

industry, particularly for foreign makes and models of vehicles.

Share-Based Payments

On January 1, 2006, we adopted the provisions of SFAS No. 123R. SFAS No. 123R replaces SFAS No. 123

and supersedes APB Opinion No. 25 and subsequently issued stock option related guidance. We elected to use the

modified-prospective method of implementation. Under this transition method, share-based compensation expense

23