Advance Auto Parts 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

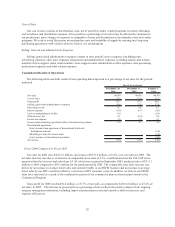

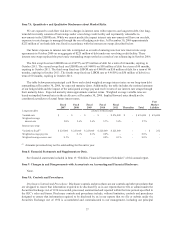

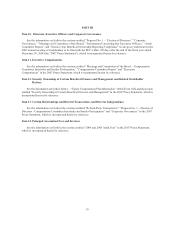

Contractual Obligations

Our future contractual obligations related to long-term debt, operating leases and other contractual obligations

at December 30, 2006 were as follows:

Fiscal Fiscal Fiscal Fiscal Fiscal

Contractual Obligations Total 2007 2008 2009 2010 2011 Thereafter

(in thousands)

Long-term debt 477,240$ 67$ 75$ 71$ 73$ 476,869$ 85$

Interest payments 122,530$ 27,536$ 27,052$ 27,010$ 27,281$ 13,651$ -$

Letters of credit 66,768$ 61,768$ 5,000$ -$ -$ -$ -$

Operating leases

(1)

2,018,132$ 249,905$ 222,693$ 205,128$ 185,473$ 162,829$ 992,104$

Purchase obligations

(2)

625$ 500$ 125$ -$ -$ -$ -$

Other long-term liabilities

(3)

61,234$ -$ -$ -$ -$ -$ -$

(1)

(2)

(3)

We lease certain store locations, distribution centers, office space, equipment and vehicles. Our property

leases generally contain renewal and escalation clauses and other leases concessions. These provisions are

considered in our calculation of our minimum lease payments which are recognized as expense on a

straight-line basis over the applicable lease term. In accordance with SFAS No. 13, “Accounting for

Leases,” as amended by SFAS No. 29, “Determining Contingent Rental,” any lease payments that are

based upon an existing index or rate, are included in our minimum lease payment calculations.

For the purposes of this table, purchase obligations are defined as agreements that are enforceable and

legally binding, a term of greater than one year and that specify all significant terms, including: fixed or

minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate

timing of the transaction. Our open purchase orders are based on current inventory or operational needs and

are fulfilled by our vendors within short periods of time. We currently do not have minimum purchase

commitments under our vendor supply agreements nor are our open purchase orders for goods and services

binding agreements. Accordingly, we have excluded open purchase orders from this table. The purchase

obligations consist of certain commitments for training and development. This agreement expires in March

2008.

Primarily includes employee benefits accruals and deferred income taxes for which no contractual payment

schedule exists.

Long Term Debt

On October 5, 2006, we entered into a new $750.0 million unsecured five-year revolving credit facility with our

subsidiary, Advance Stores Company, Incorporated, serving as the borrower. This new facility replaced the term

loans and revolver under our previous credit facility. Proceeds from this revolving loan were used to repay $433.8

million of principal outstanding on the term loans and revolver under our previous credit facility. In conjunction

with this refinancing, we wrote-off existing deferred financing costs related to our previous term loans and revolver.

The $1.9 million write-off of these costs was combined with a related gain on settlement of interest rate swaps of

$2.9 million for a net gain on extinguishment of debt of $1.0 million.

Additionally, the new facility provides for the issuance of letters of credit with a sub-limit of $300 million and

swingline loans in an amount not to exceed $50 million. We may request that the total revolving commitment be

increased by an amount not exceeding $250 million during the term of the credit agreement. Voluntary prepayments

and voluntary reductions of the revolving balance are permitted in whole or in part, at our option, in minimum

principal amounts as specified in the new revolving credit facility.

As of December 30, 2006, we had borrowed $476.8 million under the revolver and had $66.8 million in letters

of credit outstanding, which reduced availability under the revolver to $206.4 million. At December 30, 2006, we

also have interest rate swaps in place that effectively fix our interest rate exposure on approximately 50% of our

debt. These interest rate swaps are further discussed in our market risk analysis.

34