Advance Auto Parts 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

hedged debt. Therefore, the Company has recorded all adjustments to the fair value of the hedge instruments in

accumulated other comprehensive income through the maturity date of the applicable hedge arrangement. The fair

value at December 30, 2006 and December 31, 2005, respectively, was an unrecognized gain of $156 and $3,090 on

the swaps. Any amounts received or paid under these hedges will be recorded in the statement of operations as

earned or incurred.

Based on the estimated current and future fair values of the hedge arrangements at December 30, 2006, the

Company estimates amounts currently included in accumulated other comprehensive income that will be reclassified

to earnings in the next 12 months will consist of a net loss of $104 associated with the interest rate swaps.

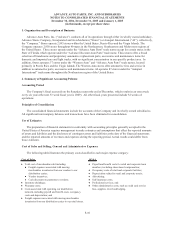

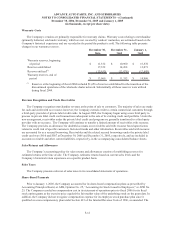

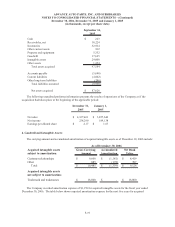

Accumulated Other Comprehensive Income

Accumulated other comprehensive income is reported in accordance with SFAS No. 130, “Reporting

Comprehensive Income.” Accumulated other comprehensive income consists of the following:

Unrealized gain

(loss) on hedge

arrangement

Adjustment to

adopt FASB

Statement No. 158

Accumulated

Other

Comprehensive

Income

Balance, January 3, 2004 (529)$ -$ (529)$

Fiscal 2004 activity 1,343 - 1,343

Balance, January 1, 2005 814$ -$ 814$

Fiscal 2005 activity 2,276 - 2,276

Balance, December 31, 2005 3,090$-$ 3,090$

Fiscal 2006 activity (2,934) 3,316 382

Balance, December 30, 2006 156$ 3,316$ 3,472$

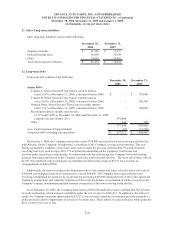

Goodwill and Other Intangible Assets

In accordance with SFAS No. 142, “Goodwill and Other Intangible Assets,” the Company tests goodwill and

other indefinite-lived intangibles for impairment at least on an annual basis. Testing for impairment is a two-step

process as prescribed in SFAS No. 142. The first step is a review for potential impairment, while the second step

measures the amount of impairment, if any. The Company has elected to complete its annual impairment test as of

the first day of its fourth quarter. An impairment loss would be recognized when the assets’ fair value is below their

carrying value. For fiscal 2006, our impairment analysis yielded no impairment.

Valuation of Long-Lived Assets

The Company evaluates the recoverability of its long-lived assets under the provisions of SFAS No. 144,

“Accounting for the Impairment or Disposal of Long-Lived Assets.” SFAS No. 144 requires the review for

impairment of long-lived assets, whenever events or changes in circumstances indicate that the carrying amount of

an asset might not be recoverable and exceeds its fair value.

Significant factors, which would trigger an impairment review, include the following:

xSignificant negative industry trends;

xSignificant changes in technology;

xSignificant underutilization of assets; and

xSignificant changes in how assets are used or are planned to be used.

When such an event occurs, the Company estimates the future cash flows expected to result from the use of the

asset and its eventual disposition. These impairment evaluations involve estimates of asset useful lives and future

F-15