Advance Auto Parts 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

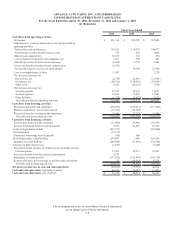

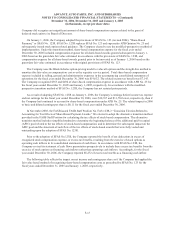

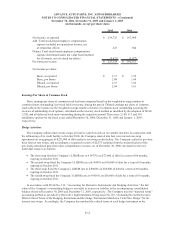

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands)

2006 2005 2004

Cash flows from operating activities:

Net income 231,318$ 234,725$ 187,988$

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation and amortization 139,423 119,938 104,877

Amortization of deferred debt issuance costs 534 620 1,082

Share-based compensation 19,052 363 494

Loss on disposal of property and equipment, net 2,103 503 447

(Benefit) provision for deferred income taxes (6,562) 2,790 6,508

Excess tax benefit from share-based compensation (5,272) - -

Tax benefit related to exercise of stock options - 30,300 23,749

Loss on extinguishment of debt 1,887 - 3,230

Net decrease (increase) in:

Receivables, net (2,318) 21,819 (15,945)

Inventories, net (92,239) (130,426) (87,669)

Other assets 9,412 (23,963) 1,750

Net increase (decrease) in:

Accounts payable 22,339 35,610 19,673

Accrued expenses 15,264 32,805 12,581

Other liabilities (1,337) (3,452) 1,632

Net cash provided by operating activities 333,604 321,632 260,397

Cash flows from investing activities:

Purchases of property and equipment (258,586) (216,214) (179,766)

Business acquisitions, net of cash acquired (12,500) (99,300) -

Proceeds from sales of property and equipment 12,444 12,734 12,944

Net cash used in investing activities (258,642) (302,780) (166,822)

Cash flows from financing activities:

(Decrease) increase in bank overdrafts (15,964) 29,986 (10,901)

Increase in financed vendor accounts payable 8,192 62,455 56,896

Early extinguishment of debt (433,775) - (105,000)

Dividends paid (19,153) - -

(Payments) borrowings on note payable (60) 500 -

Borrowings under credit facilities 678,075 1,500 256,500

Payments on credit facilities (205,800) (33,200) (126,500)

Payment of debt related costs (1,070) - (3,509)

Proceeds from the issuance of common stock, primarily exercise

of stock options 17,203 32,275 23,867

Excess tax benefit from share-based compensation 5,272 - -

Repurchase of common stock (137,560) (101,594) (146,370)

Increase (decrease) in borrowings secured by trade receivables 23 (26,312) 6,276

Net cash used in financing activities (104,617) (34,390) (48,741)

Net (decrease) increase in cash and cash equivalents (29,655) (15,538) 44,834

Cash and cash equivalents, beginning of period 40,783 56,321 11,487

Cash and cash equivalents, end of period 11,128$ 40,783$ 56,321$

Fiscal Years Ended

The accompanying notes to consolidated financial statements

are an integral part of these statements.

F-8