Advance Auto Parts 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

December 30, 2006, December 31, 2005 and January 1, 2005

(in thousands, except per share data)

defined in the individual lease agreements. Most of the leases provide that the Company pays taxes, maintenance,

insurance and certain other expenses applicable to the leased premises and include options to renew. Management

expects that, in the normal course of business, leases that expire will be renewed or replaced by other leases.

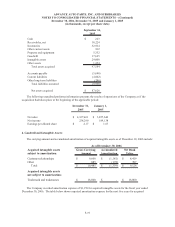

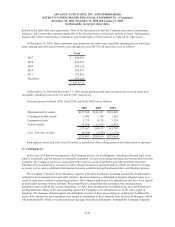

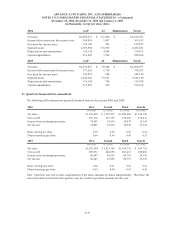

At December 30, 2006, future minimum lease payments due under non-cancelable operating leases with lease

terms ranging from one year to twenty years through the year 2027 for all open stores are as follows:

Total

2007 249,905$

2008 222,693

2009 205,128

2010 185,473

2011 162,829

Thereafter 992,104

2,018,132$

At December 30, 2006 and December 31, 2005, future minimum sub-lease income to be received under non-

cancelable operating leases is $7,333 and $7,929, respectively.

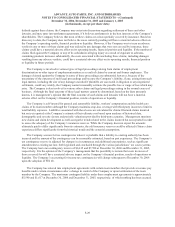

Net rent expense for fiscal 2006, fiscal 2005 and fiscal 2004 was as follows:

2006 2005 2004

Minimum facility rentals 217,588$ 191,897$ 169,449$

Contingent facility rentals 1,090 1,334 1,201

Equipment rentals 5,735 4,128 5,128

Vehicle rentals 13,554 11,316 6,007

237,967 208,675 181,785

Less: Sub-lease income (4,166) (3,665) (3,171)

233,801$ 205,010$ 178,614$

Rent expense associated with closed locations is included in other selling, general and administrative expenses.

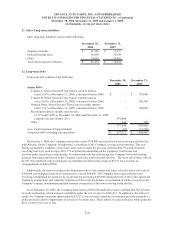

16. Contingencies:

In the case of all known contingencies, the Company accrues for an obligation, including estimated legal costs,

when it is probable and the amount is reasonably estimable. As facts concerning contingencies become known to the

Company, the Company reassesses its position with respect to accrued liabilities and other potential exposures.

Estimates that are particularly sensitive to future change include tax and legal matters, which are subject to change

as events evolve, and as additional information becomes available during the administrative and litigation process.

The Company’s Western Auto subsidiary, together with other defendants including automobile manufacturers,

automotive parts manufacturers and other retailers, has been named as a defendant in lawsuits alleging injury as a

result of exposure to asbestos-containing products. The Company and some of its subsidiaries also have been named

as defendants in many of these lawsuits. The plaintiffs have alleged that these products were manufactured,

distributed and/or sold by the various defendants. To date, these products have included brake and clutch parts and

roofing materials. Many of the cases pending against the Company or its subsidiaries are in the early stages of

litigation. The damages claimed against the defendants in some of these proceedings are substantial. Additionally,

some of the automotive parts manufacturers named as defendants in these lawsuits have declared bankruptcy, which

will limit plaintiffs’ ability to recover monetary damages from those defendants. Although the Company diligently

F-28