Singapore Airlines 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 04/05 97

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

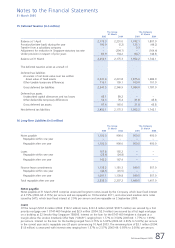

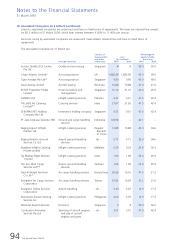

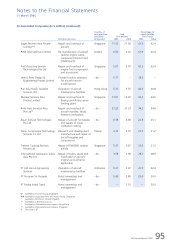

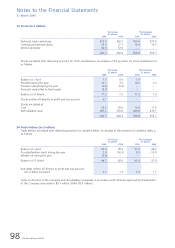

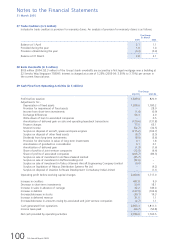

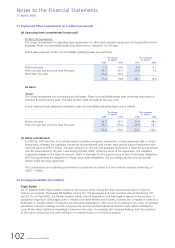

22 Long-Term Investments (in $ million)

The Group The Company

31 March 31 March

2005 2004 2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Quoted investments at cost

Equity investments – 51.4 – 432.0

Provision for diminution – – – (380.6)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

– 51.4 – 51.4

Non-equity investments 389.8 291.3 389.8 291.3

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

389.8 342.7 389.8 342.7

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Unquoted investments at cost

Trade investments 71.6 74.3 47.2 47.2

Non-equity investments – 40.2 – 40.2

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

71.6 114.5 47.2 87.4

Provision for diminution (27.8) (27.7) (27.8) (27.7)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

43.8 86.8 19.4 59.7

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Long-term loans 42.7 45.7 – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

476.3 475.2 409.2 402.4

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Market value of quoted investments

Equity investments – 131.5 – 131.5

Non-equity investments 390.4 297.0 390.4 297.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

390.4 428.5 390.4 428.5

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Analysis of provision for diminution in value

of quoted and unquoted investments

Balance at 1 April 27.7 25.9 408.3 406.5

Provided during the year 0.1 1.8 0.1 1.8

Provision written off during the year – – (380.6) –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 27.8 27.7 27.8 408.3

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

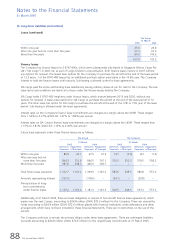

Non-equity investments of $389.8 million (2004: $331.5 million) for the Group and the Company relate to interest-

bearing investments with an effective annual interest rate of 1.71% (2003-04: 1.75%).

The Group’s long-term loans comprise:-

(a) Loan to August Skyfreighter 1994 Trust of $42.7 million (2004: $43.5 million) is unsecured and bears interest

between 1.56% and 3.19% (2003-04: 1.47% to 1.74%) per annum. The loan is repayable on 28 March 2007; and

(b) Shareholders’ loan to Hong Kong Aero Engine Services Limited of US$1.3 million was repaid during the financial

year.

In October 2004, the Company completed its placement of 37,833,309 (after share consolidation of five to one ratio)

ordinary shares in Air New Zealand at a price of NZ$1.63 per share, representing a 3% discount on the previous closing

price. The proceed from disposal of the entire 6.47% equity interest in Air New Zealand was $68.5 million. Surplus on

disposal of the investment was $45.7 million (refer to note 9 to the financial statements).

In May 2004, the Company received $13.9 million capital distribution from Raffles Hotels Limited as part of its capital

reduction exercise from par value of $0.50 per share to $0.32 per share. On 3 March 2005, the Company disposed of its

entire shareholding in Raffles Hotels Limited for $47.3 million. Surplus on disposal of the investment was $32.6 million

(refer to note 9 to the financial statements).

On 15 October 2004, SIAEC disposed of its entire 5% equity interest in Taikoo (Xiamen) Aircraft Engineering Company

Limited to Hong Kong Aircraft Engineering Company Limited for a total cash consideration of $11.7 million (US$7.5

million). Surplus on disposal of the investment was $9.0 million (refer to note 9 to the financial statements).