Singapore Airlines 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

SIA Annual Report 04/05 45

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

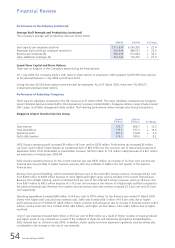

Performance of the Group (continued)

Value Added

Total value added for 2004-05 improved 37.1 per cent (+$1,498 million) to $5,534 million. The increase was mainly

attributable to higher revenue (+$2,251 million), higher share of profits of associated and joint venture companies (+$124

million), higher surplus on disposal of aircraft, spares and spare engines (+$113 million) and surplus on sale of long-term

investments (+$87 million), partially offset by higher purchase of goods and services (-$1,099 million).

Payroll and other staff cost accounted for 43.7 per cent of the value added, 5.1 percentage points lower than the previous

year. $487 million (8.8 per cent) of the value added was for distribution to shareholders, $78 million (1.4 per cent) for

finance charges, and $53 million (1.0 per cent) belonged to minority interests. $2,111 million was retained for future capital

requirements.

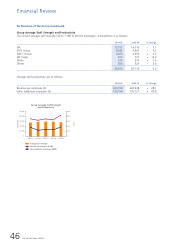

Group Value Added Distribution

$ Million

$ Million

2000-01 2001-02 2002-03 2003-04 2004-05

2,500

2,000

1,500

1,000

500

0

Retained in the Business

Employees

Suppliers of Capital

Government

2,500

2,000

1,500

1,000

500

0

R1

R1

Group Valued Added Distribution

2004-05

+0.9% point

-5.1% points

+0.4% point

+3.8% points

Retained in the Business 2,111 38.1

Suppliers of Capital 618 11.2

Government 387 7.0

Employees 2,418 43.7

Total Value Added

$million Distribution

%

43.7% 38.1%

11.2%

7.0%

Group Value Added Productivity Ratios

Dollar

Dollar

2000-01 2001-02 2002-03 2003-04 2004-05

Value Added Per $ Employment Cost

Value Added Per $ Revenue

Value Added Per $ Investment in Fixed Assets

2.5

2.0

1.5

1.0

0.5

0

2.5

2.0

1.5

1.0

0.5

0

R1 Excludes write-back of prior year's tax liabilities of $204.7

million and $277.8 million for 2003-04 and 2002-03

respectively arising from reduction in statutory tax rate.