Singapore Airlines 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 04/05 87

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

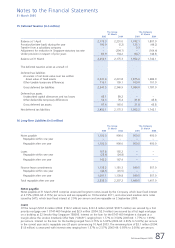

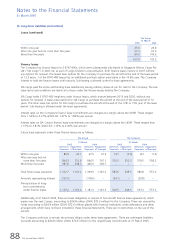

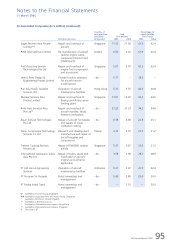

15 Deferred Taxation (in $ million)

The Group The Company

31 March 31 March

2005 2004 2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 1 April 2,175.3 2,251.0 1,742.1 1,807.9

Provision/(written-back) during the year 190.9 (5.2) 125.1 (46.2)

Transfer from a subsidiary company – – 0.3 –

Adjustment for reduction in Singapore statutory tax rate – (204.7) – (164.4)

Under provision in respect of prior years 83.9 134.2 84.7 144.8

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 2,450.1 2,175.3 1,952.2 1,742.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The deferred taxation arises as a result of:

Deferred tax liabilities

An excess of net book value over tax written

down value of fixed assets 2,431.4 2,231.8 1,875.0 1,686.9

Other taxable temporary differences 116.1 109.1 109.0 101.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gross deferred tax liabilities 2,547.5 2,340.9 1,984.0 1,787.9

Deferred tax assets

Unabsorbed capital allowances and tax losses 45.1 89.2 – –

Other deductible temporary differences 52.3 76.4 31.8 45.8

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Gross deferred tax assets 97.4 165.6 31.8 45.8

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net deferred tax liabilities 2,450.1 2,175.3 1,952.2 1,742.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

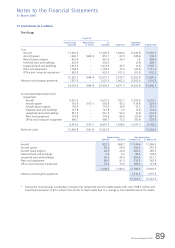

16 Long-Term Liabilities (in $ million)

The Group The Company

31 March 31 March

2005 2004 2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Notes payable 1,100.0 900.0 900.0 900.0

Repayable within one year – – – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Repayable after one year 1,100.0 900.0 900.0 900.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Loans 167.8 192.2 – –

Repayable within one year (25.6) (24.8) – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Repayable after one year 142.2 167.4 – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Finance lease commitments 1,135.2 1,181.3 549.5 557.0

Repayable within one year (44.1) (41.5) – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Repayable after one year 1,091.1 1,139.8 549.5 557.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total repayable after one year 2,333.3 2,207.2 1,449.5 1,457.0

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Notes payable

Notes payable at 31 March 2005 comprise unsecured long-term notes issued by the Company, which bear fixed interest

at 4.15% (2003-04: 4.15%) per annum and are repayable on 19 December 2011, and unsecured medium-term notes

issued by SATS, which bear fixed interest at 3.0% per annum and are repayable on 2 September 2009.

Loans

Of the Group’s $167.8 million (2004: $192.2 million) loans, $161.8 million (2004: $187.5 million) are secured by a first

priority mortgage over 1 B747-400 freighter and $2.9 million (2004: $2.9 million) are secured by a first legal mortgage

on a building at 22 Senoko Way Singapore 758095. Interest on the loan for the B747-400 freighter is charged at a

margin above the London Interbank Offer Rate (“LIBOR”) ranging from 1.77% to 3.54% (2003-04: 1.77% to 1.99%)

per annum. Interest on the loan for the building ranged from 3.75% to 5.00% (2003-04: 3.50% to 5.00%) per annum

in the current year and is repayable over 20 years commencing 10 April 2003. The remaining loan of $3.1 million (2004:

$1.8 million) is unsecured with interest rates ranging from 1.37% to 2.57% (2003-04: 0.93% to 2.00%) per annum.