Singapore Airlines 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIA Annual Report 04/05 73

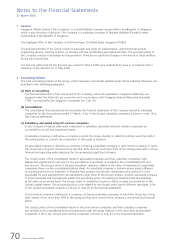

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

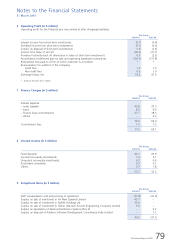

2 Accounting Policies (continued)

(i) Investments

Investments held on a long-term basis are stated at cost and provisions are made for diminution in value which is

considered to be permanent. Short-term investments are stated at the lower of cost and net realisable value on a

portfolio basis.

(j) Stocks

Stocks are stated at the lower of cost and net realisable value. Cost is determined on a weighted average basis.

Net realisable value is the estimated selling price in the ordinary course of business less estimated costs necessary to

make the sale.

Work-in-progress is stated at cost plus estimated attributable profit.

(k) Trade debtors

Trade debtors are recognised and carried at original invoiced amount less an allowance for any uncollectible

amounts. An estimate for doubtful debts is made when collection of the full amount is no longer probable. Bad

debts are written-off as incurred.

Amounts owing by subsidiary, associated and joint venture companies are recognised and carried at cost less

provisions for any uncollectible amounts.

(l) Cash and bank balances

Cash and bank balances are defined as cash on hand, demand deposits and short-term, highly liquid investments

readily convertible to known amounts of cash and subject to insignificant risk of changes in value.

Cash on hand, demand deposits and short-term deposits which are held to maturity are carried at cost.

For the purposes of the Consolidated Cash Flow Statement, cash and cash equivalents consist of cash on hand and

deposits in banks, net of outstanding bank overdrafts.

(m) Deferred taxation

Deferred tax is provided, using the liability method, on all temporary differences at the balance sheet date between

the tax bases of assets and liabilities and their carrying amounts for financial reporting purposes.

Additionally the Group’s deferred tax liabilities include all taxable temporary differences associated with investments

in subsidiary, associated and joint venture companies, except where the timing of the reversal of the temporary

differences can be controlled and it is probable that the temporary differences will not reverse in the foreseeable

future.

Deferred tax assets are recognised for all deductible temporary differences and, carry forward of unused tax

assets and losses, to the extent that it is probable that taxable profit will be available against which the deductible

temporary differences and, carry forward of unused tax assets and losses, can be utilised.

The carrying amount of deferred tax assets is reviewed at each balance sheet date and reduced to the extent that it

is no longer probable that sufficient taxable profits will be available to allow all or part of the deferred tax assets to

be utilised.

Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the

asset is realised or the liability is settled, based on tax rates (and tax laws) that have been enacted or substantively

enacted at the balance sheet date.

Deferred tax is charged or credited directly to equity if the tax relates to items that are credited or charged in the

same or a different period, directly to equity.

(n) Loans, notes payable and borrowings

Loans, notes payable and other borrowings are recognised at cost.