Singapore Airlines 2005 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 SIA Annual Report 04/05

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

13col

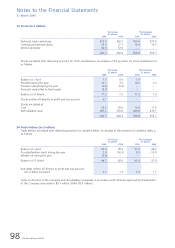

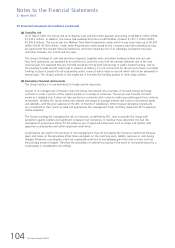

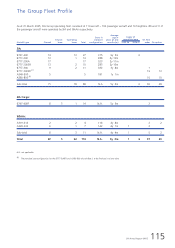

33 Financial Instruments (in $ million) (continued)

(i) Net fair values (continued)

Total carrying amount Aggregate net

on Balance Sheet fair value

31 March 31 March

2005 2004 2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Company

Financial Assets

Long-term investments 409.2 402.4 409.8 488.2

Financial Liabilities

Notes payable 900.0 900.0 940.4 935.7

Derivative financial instruments

Foreign currency contracts * * (23.8) (22.5)

Jet fuel swap contracts * * 36.8 63.0

Jet fuel options contracts * * 209.1 18.0

Interest rate swap contracts * * 26.8 46.6

* No balance sheet carrying amounts are shown as these are commitments as at year end.

The fair value of quoted investments is generally determined by reference to stock exchange quoted market bid

prices at the close of the business on the balance sheet date. It is not practicable to determine, with sufficient

reliability without incurring excessive costs, the fair value of unquoted investments as they do not have quoted

market prices in an active market nor are other methods of reasonably estimating the fair values readily available.

As such, the fair value of these investments is based on either acquisition cost or the attributable net assets of those

companies.

The carrying values of the long-term lease commitments approximate their fair values as they are based on LIBOR.

The fair value of forward currency contracts is determined by reference to current forward prices for contracts with

similar maturity profiles. The fair value of interest rate contracts is calculated using rates assuming these contracts

are liquidated at balance date. The fair value of jet fuel swap contracts is determined by reference to market values

for similar instruments. The fair value of jet fuel option contracts is determined by reference to available market

information and option valuation methodology.

The carrying amounts of the following financial assets and liabilities approximate their fair values due to their short-

term nature: cash and bank balances, bank overdrafts, funds from subsidiary companies, amounts owing by/to

subsidiary, associated and joint venture companies, loans, finance lease commitments, trade debtors and creditors.

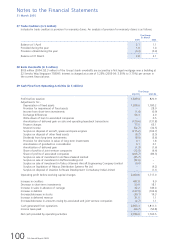

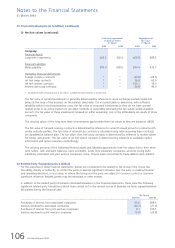

34 Related Party Transactions (in $ million)

For the purposes of these financial statements, parties are considered to be related to the Group if the Group has

the ability, directly or indirectly, to control the party or exercise significant influence over the party in making financial

and operating decisions, or vice versa, or where the Group and the party are subject to common control or common

significant influence. Related parties may be individuals or other entities.

In addition to the related party information disclosed elsewhere in the financial statements, these were the following

significant related party transactions which were carried out in the normal course of business on terms agreed between

the parties during the financial year:

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Purchases of services from associated companies 40.6 288.6

Services rendered to associated companies (24.7) (21.2)

Purchases of services from joint venture companies 0.1 104.1

Services rendered to joint venture companies (5.5) (24.8)