Singapore Airlines 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 04/05 93

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

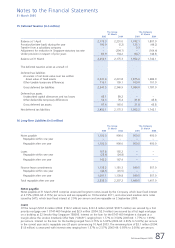

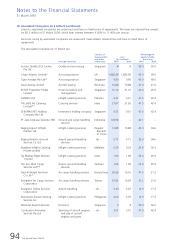

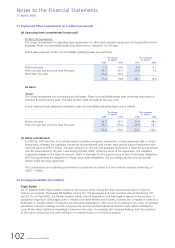

20 Associated Companies (in $ million)

The Group The Company

31 March 31 March

2005 2004 2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Share of net tangible assets of associated companies

at acquisition date 409.7 375.7 – –

Goodwill on acquisition of associated companies 1,768.0 1,626.2 – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Unquoted investments at cost 2,177.7 2,001.9 1,729.9 1,725.0

Impairment loss (18.5) (25.6) (20.3) (9.4)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

2,159.2 1,976.3 1,709.6 1,715.6

Goodwill written-off to reserves (1,613.0) (1,613.0) – –

Accumulated amortisation of goodwill on acquisition (14.5) (7.6) – –

Currency realignment (6.3) 0.9 – –

Share of post acquisition reserves

– general reserve 226.0 130.8 – –

– capital reserve 32.1 22.9 – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

783.5 510.3 1,709.6 1,715.6

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Loans to associated companies 12.0 17.8 6.5 7.1

Write-down of loans (5.5) (10.6) – –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

6.5 7.2 6.5 7.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

790.0 517.5 1,716.1 1,722.7

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Amounts owing by associated companies 15.8 0.4 12.5 –

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

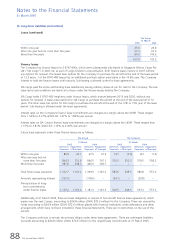

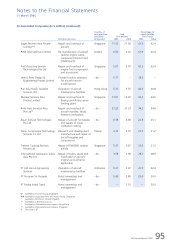

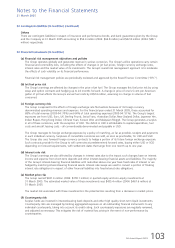

During the financial year:

1. The Company’s associated company, RCMS Properties Private Limited, recorded a revaluation surplus of $46.1 million

from its annual revaluation exercise of its land and building. The Company’s share of the revaluation surplus of $9.2

million at 31 March 2005 is included under the Group’s share of post-acquisition capital reserve (refer to Statement

of Changes in Equity – The Group for the financial year ended 31 March 2005).

2. The Company injected an additional $4.9 million in Tiger Airways Pte Ltd (“Tiger Airways”). There was no change in

the Company’s 49.0% equity stake in Tiger Airways.

3. The Company provided $10.9 million impairment on its investment in Asia Leasing Limited. The impairment was

reversed out from the Group as the share of post acquisition reserve is equity accounted in the Group’s accounts.

4. SATS acquired an additional 24.5% equity interest in Asia Airfreight Terminal Company Limited from Changi

International Airport Services Pte Ltd for a consideration of $76.5 million. This brings the total equity interest held by

SATS to 49.0%. Goodwill arising from the additional equity interest, amounting to $41.5 million was capitalised and

amortised over a period of 20 years.

5. TAJ SATS Air Catering refunded $3.3 million as return on shareholders’ funds to SATS on 8 September 2004.

6. SATS purchased approximately 49.8% of the ground and cargo handling business of PT Jasa Angkasa Semesta TBK

from Devro Group Limited for US$61.3 million (S$104.0 million). Goodwill arising from the acquisition of $100.3

million was capitalised and amortised over a period of 20 years.

7. SIAEC, Jamco Corporation and Jamco America, Inc. incorporated a company, Jamco Aero Design & Engineering

Private Limited (“JADE”). SIAEC injected $0.8 million for its 45.0% equity interest in JADE.

8. SIAP has sold its entire 20% shareholding in the Indonesian company PT Pantai Indah Tateli (“PTPIT”) to Pacific Link

Asset Management Co Ltd for a consideration of US$1.20. PTPIT was incorporated to build and operate a hotel in

Manado, North Sulawesi. As the hotel has not been in operation, SIAP has written down the book value of its stake

in PTPIT to zero prior to the disposal.