Singapore Airlines 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 04/05 99

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

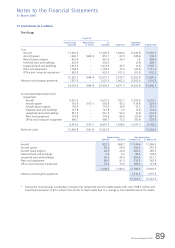

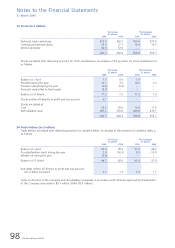

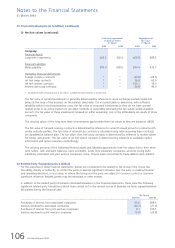

25 Investments (in $ million)

The Group

31 March

2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Quoted investments at cost

Government securities 6.9 4.6

Equity investments 21.3 16.8

Non-equity investments 14.3 14.6

–––––––––––––––––––––––––––––––––

42.5 36.0

–––––––––––––––––––––––––––––––––

Unquoted investments at cost

Non-equity investments 37.7 94.8

–––––––––––––––––––––––––––––––––

80.2 130.8

–––––––––––––––––––––––––––––––––

Provision for diminution

Government securities (0.1) –

Non-equity investments, quoted (0.8) (0.6)

–––––––––––––––––––––––––––––––––

(0.9) (0.6)

–––––––––––––––––––––––––––––––––

79.3 130.2

–––––––––––––––––––––––––––––––––

Market value of quoted investments

Government securities 6.8 4.6

Equity investments 24.7 20.5

Non-equity investments 13.5 14.0

–––––––––––––––––––––––––––––––––

45.0 39.1

–––––––––––––––––––––––––––––––––

Analysis of provision for diminution in value

of quoted investments:

Balance at 1 April 0.6 2.8

Provided/(written-back) during the year 0.3 (2.2)

–––––––––––––––––––––––––––––––––

Balance at 31 March 0.9 0.6

–––––––––––––––––––––––––––––––––

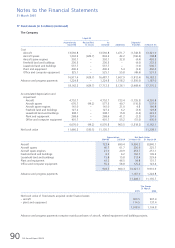

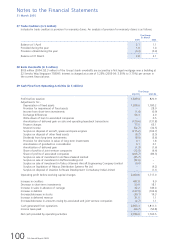

26 Cash and Bank Balances (in $ million)

The Group The Company

31 March 31 March

2005 2004 2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fixed deposits 2,231.9 1,137.1 2,049.1 918.3

Cash and bank 608.3 381.4 460.0 172.3

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

2,840.2 1,518.5 2,509.1 1,090.6

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––