Singapore Airlines 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66 SIA Annual Report 04/05

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

13col

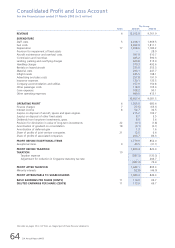

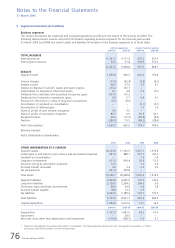

Statements of Changes in Equity

For the financial year ended 31 March 2005 (in $ million)

The Group

Foreign

Capital currency

Share Share redemption Capital translation General

Notes capital premium reserve reserve reserve reserve Total

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 2003 609.1 447.2 64.4 7.7 41.3 9,539.1 10,708.8

Currency translation differences – – – – (21.5) – (21.5)

Share of a joint venture

company’s capital reserve – – – 1.4 – – 1.4

Share of an associated company’s

capital reserve – – – 22.9 – – 22.9

Gain on dilution of interest in

subsidiary companies due to

share options exercised – – – – – 3.8 3.8

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net gains and losses not

recognised in the profit

and loss account – – – 24.3 (21.5) 3.8 6.6

Profit attributable to shareholders

for the financial year – – – – – 849.3 849.3

Dividends 12 – – – – – (109.6) (109.6)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 2004 609.1 447.2 64.4 32.0 19.8 10,282.6 11,455.1

Currency translation differences – – – – (11.0) – (11.0)

Share options exercised 13 * 1.0 – – – – 1.0

Share of a joint venture

company’s capital reserve 21 – – – 0.7 – – 0.7

Share of an associated

company’s capital reserve 20 – – – 9.2 – – 9.2

Gain on dilution of interest in

subsidiary companies due

to share options exercised – – – – – 18.2 18.2

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Net gains and losses not

recognised in the profit

and loss account * 1.0 – 9.9 (11.0) 18.2 18.1

Profit attributable to shareholders

for the financial year – – – – – 1,389.3 1,389.3

Dividends 12 – – – – – (426.4) (426.4)

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Balance at 31 March 2005 609.1 448.2 64.4 41.9 8.8 11,263.7 12,436.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

* Amount less than $0.1 million

During the year, 85,324 ordinary shares of $0.50 par value were issued at exercise price of $10.34 each, and 9,700 ordinary shares of $0.50 par value were

issued at exercise price of $11.96 each pursuant to the Employee Share Option Plan. Share capital and share premium increased by $47,512 and $950,750

respectively.

The notes on pages 70 to 107 form an integral part of these financial statements.