Singapore Airlines 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

SIA Annual Report 04/05 53

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

Performance of the Company (continued)

Finance Charges

Finance charges increased 5.9 per cent due mainly to higher interest rates on lease liabilities.

Interest income was 52.3 per cent higher due mainly to an increase in income from deposits.

Surplus on Disposal of Aircraft, Spares and Spare Engines

Surplus on the disposal of aircraft, spares and spare engines was $77 million higher than the year before benefiting from a

stronger market. During the year, four B747-400 aircraft were sold, two B747-400 and one A310-300 aircraft were traded-

in, and two B777-200ER and one B777-300 aircraft were sold and leased back.

Gross Dividends from Subsidiary and Associated Companies

Gross dividends from subsidiary and associated companies increased by $518 million. Higher dividends were received from

Singapore Airport Terminal Services (+$331 million), SIA Engineering Company (+$183 million), Virgin Atlantic Limited (+$2

million) and Service Quality Centre (+$1 million). Unlike last year, $3 million was received from Asia Leasing (+$3 million) but

no dividend was received from SIA Properties (-$2 million).

Provision for Diminution in Value of Investments

The $11 million provision for diminution in value of investments pertained to investments in Asia Leasing and AeroXchange.

Exceptional Items

Exceptional items comprised surplus on sale of investment in Air New Zealand (+$46 million) and Raffles Holdings (+$32

million), and staff compensation arising from the restructuring of operations (-$9 million).

Taxation

There was a tax charge of $287 million, comprising current tax charge of $77 million and deferred tax provision of $210

million. As at 31 March 2005, the company’s deferred taxation account stood at $1,952 million.

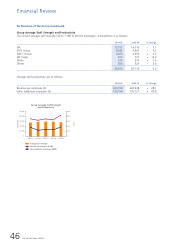

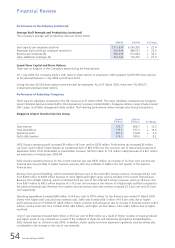

Average Staff Strength and Productivity

The Company’s average staff strength was 13,572, a decrease of 438 over the previous year. The distribution of employee

strength by category and location is as follows:

2004-05 2003-04 % Change

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Category

Senior staff (administrative and higher ranking officers) 1,265 1,368 – 7.5

Technical crew 1,912 1,873 + 2.1

Cabin crew 6,637 6,678 – 0.6

Other ground staff 3,758 4,091 – 8.1

––––––––––––––––––––––––––––––––––––––––––––––––––––

13,572 14,010 – 3.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Location

Singapore 11,261 11,545 – 2.5

East Asia 1,001 1,064 – 5.9

Europe 460 508 – 9.4

South West Pacific 364 372 – 2.2

West Asia and Africa 247 259 – 4.6

Americas 239 262 – 8.8

––––––––––––––––––––––––––––––––––––––––––––––––––––

13,572 14,010 – 3.1

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––