Singapore Airlines 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIA Annual Report 04/05 103

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

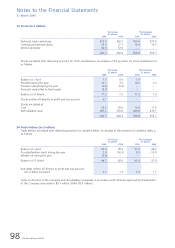

32 Contingent Liabilities (in $ million) (continued)

Others

There are contingent liabilities in respect of insurance and performance bonds, and bank guarantees given by the Group

and the Company at 31 March 2005 amounting to $56.4 million (2004: $64.8 million) and $22.8 million (2004: $28.1

million) respectively.

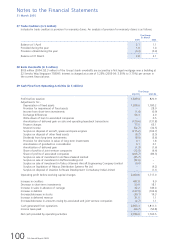

33 Financial Instruments (in $ million)

(a) Financial risk management objectives and policies

The Group operates globally and generates revenue in various currencies. The Group’s airline operations carry certain

financial and commodity risks, including the effects of changes in jet fuel prices, foreign currency exchange rates,

interest rates and the market value of its investments. The Group’s overall risk management approach is to moderate

the effects of such volatility on its financial performance.

Financial risk management policies are periodically reviewed and approved by the Board Finance Committee (“BFC”).

(b) Jet fuel price risk

The Group’s earnings are affected by changes in the price of jet fuel. The Group manages this fuel price risk by using

swap and option contracts and hedging up to 24 months forward. A change in price of one US cent per American

gallon of jet fuel affects the Group’s annual fuel costs by US$14 million, assuming no change in volume of fuel

consumed.

(c) Foreign currency risk

The Group is exposed to the effects of foreign exchange rate fluctuations because of its foreign currency

denominated operating revenues and expenses. For the financial year ended 31 March 2005, these accounted for

68% of total revenue (2003-04: 70%) and 64% of total operating expenses (2003-04: 51%). The Group’s largest

exposures are from USD, Euro, UK Sterling Pound, Swiss Franc, Australian Dollar, New Zealand Dollar, Japanese Yen,

Indian Rupee, Hong Kong Dollar, Chinese Yuan, Korean Won and Malaysian Ringgit. The Group generates a surplus

in all of these currencies, with the exception of USD. The deficit in USD is attributable to capital expenditure, fuel

costs and aircraft leasing costs – all conventionally denominated and payable in USD.

The Group manages its foreign exchange exposure by a policy of matching, as far as possible, receipts and payments

in each individual currency. Surpluses of convertible currencies are sold, as soon as practicable, for USD and SGD.

The Group also uses forward foreign currency contracts to hedge a portion of its future foreign exchange exposure.

Such contracts provide for the Group to sell currencies at predetermined forward rates, buying either USD or SGD

depending on forecast requirements, with settlement dates that range from one month up to one year.

(d) Interest rate risk

The Group’s earnings are also affected by changes in interest rates due to the impact such changes have on interest

income and expense from short-term deposits and other interest-bearing financial assets and liabilities. The majority

of the Group’s interest-bearing financial liabilities with maturities above one year have fixed rates of interest or are

hedged by matching interest-bearing financial assets. Interest rate swaps are used to convert a portion of floating

interest rate obligations in respect of other financial liabilities into fixed interest rate obligations.

(e) Market price risk

The Group owned $431.4 million (2004: $378.1 million) in quoted equity and non-equity investments at

31 March 2005. The estimated market value of these investments was $435.4 million (2004: $467.6 million) at

31 March 2005.

The market risk associated with these investments is the potential loss resulting from a decrease in market prices.

(f) Counterparty risk

Surplus funds are invested in interest-bearing bank deposits and other high quality short-term liquid investments.

Counterparty risks are managed by limiting aggregated exposure on all outstanding financial instruments to any

individual counterparty, taking into account its credit rating. Such counterparty exposures are regularly reviewed,

and adjusted as necessary. This mitigates the risk of material loss arising in the event of non-performance by

counterparties.