Singapore Airlines 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 SIA Annual Report 04/05

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

13col

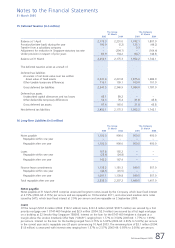

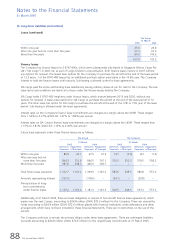

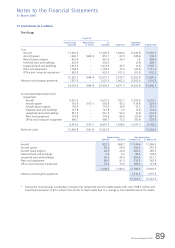

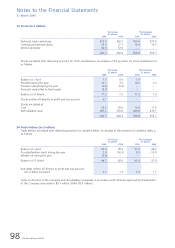

16 Long-Term Liabilities (in $ million)

Loans (continued)

The Group

31 March

2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Within one year 25.6 24.8

After one year but not more than five years 57.9 67.2

More than five years 84.3 100.2

–––––––––––––––––––––––––––––––––

167.8 192.2

–––––––––––––––––––––––––––––––––

Finance leases

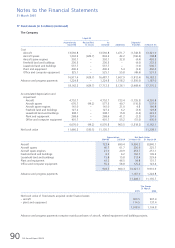

The Company has finance leases for 2 B747-400s, which were subsequently sub-leased to Singapore Airlines Cargo Pte

Ltd (“SIA Cargo”) in 2001-02, as part of Cargo Division’s corporatisation. Both finance leases mature in 2007 without

any options for renewal. The leases have options for the Company to purchase the aircraft at the end of the lease period

of 12.5 years. 1 of the B747-400 leases has an additional purchase option exercisable in the 10.5th year. The Company

intends to hold the finance leases until maturity. Sub-leasing is allowed under the lease agreements.

SIA Cargo paid the entire outstanding lease liabilities by issuing ordinary shares at par for cash to the Company. The sub-

lease terms and conditions are identical to those under the finance leases held by the Company.

SIA Cargo holds 3 B747-400 freighters under finance leases, which mature between 2015 and 2026, without any

options for renewal. 2 leases have options for SIA Cargo to purchase the aircraft at the end of the lease period of 12

years. The other lease has option for SIA Cargo to purchase the aircraft at the end of the 12th or 15th year of the lease

period. Sub-leasing is allowed under the lease agreements.

Interest rates on the Company’s finance lease commitments are charged at a margin above the LIBOR. These ranged

from 1.56% to 2.31% (2003-04: 1.47% to 1.84%) per annum.

Interest rates on SIA Cargo’s finance lease commitments are charged at a margin above the LIBOR. These ranged from

1.15% to 3.81% (2003-04: 1.12% to 2.00%) per annum.

Future lease payments under these finance leases are as follows:

The Group The Company

–––––––––––––––––––––––––––––––––––––––––––––––––– –––––––––––––––––––––––––––––––––––––––––––––––––––

31 March 31 March

2005 2004 2005 2004

Minimum Repayment Minimum Repayment Minimum Repayment Minimum Repayment

Payments of Principal Payments of Principal Payments of Principal Payments of Principal

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Within one year 80.8 44.1 67.5 41.5 13.1 (2.8) 8.3 (1.2)

After one year but not

more than five years 864.3 752.8 846.5 747.1 570.5 552.3 578.5 558.2

More than five years 387.6 338.3 445.9 392.7 – – – –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Total future lease payments 1,332.7 1,135.2 1,359.9 1,181.3 583.6 549.5 586.8 557.0

Amounts representing interest (197.5) (178.6) – (34.1) – (29.8) –

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Principal value of long-

term commitments

under finance leases 1,135.2 1,135.2 1,181.3 1,181.3 549.5 549.5 557.0 557.0

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Additionally, at 31 March 2005, there are lease obligations in respect of two aircraft finance lease agreements, which

expire over the next 2 years, amounting to $24.8 million (2004: $72.6 million) for the Company. These are covered by

funds amounting to $24.8 million (2004: $72.6 million) placed with financial institutions under defeasance and other

arrangements which have not been included in these financial statements. There are no restrictions on the use of the

aircraft.

The Company continues to remain the primary obligor under these lease agreements. There are contingent liabilities

(secured) amounting to $24.8 million (2004: $72.6 million) for the unpaid lease commitments at 31 March 2005.