Singapore Airlines 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

52 SIA Annual Report 04/05

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

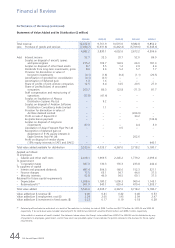

Performance of the Company (continued)

Expenditure (continued)

Staff costs increased $300 million mainly due to higher provision for profit-sharing bonus this year (4 months’ salary versus

2.05 months’ salary last year).

Depreciation charges decreased $25 million mainly due to (i) impairment charge of aircraft spares and A310-300 fleet in

the previous year; (ii) the full year’s impact of trade-in of three A340-300, four A310-300 and two B747-400 aircraft, and

sale and leaseback of one B747-400 and one B777-300 aircraft last year; and (iii) sale of four B747-400 aircraft, trade-in of

two B747-400 and one A310-300 aircraft, and sale and leaseback of two B777-200ER and one B777-300 aircraft during

the year. The decrease was partially offset by (i) the commissioning of two B777-200, three B777-300 and two A340-500

aircraft during the year; and (ii) the full year’s impact of five B777-200A, one B777-200, one B777-200ER and three A340-

500 aircraft commissioned in the previous year.

Aircraft maintenance and overhaul (AMO) costs fell $27 million. The reduction was mainly due to concerted efforts in

optimising maintenance work at reduced cost as well as reduced maintenance activities for the A310-300 non-operating

aircraft.

Handling costs, at $721 million, was 14.9 per cent more than last year due to the increase in the number of flights

operated.

Sales costs increased $196 million from the year before, mainly due to (i) more agents qualifying for higher incentive

payments compared to the previous year, when many failed to meet sales targets due to the after-effects of Severe Acute

Respiratory Syndrome (SARS); (ii) higher computer reservation systems booking fees as more bookings were made; and (iii)

more advertising and sales promotion activities.

Inflight meals and other passenger costs rose $95 million as a result of more passengers carried (+20.1 per cent).

Airport and overflying charges were $97 million higher compared to last year. The increase came from an increase in the

number of flights operated and higher rates mainly due to cessation of discount on landing fees at Changi Airport after

December 2003.

Rentals on leased aircraft decreased $3 million mainly because of (i) completion of the leases for three B747-400 aircraft

during the year; and (ii) a weaker US dollar (USD). The decrease was partially offset by (i) additional sale and leaseback of

one B777-300 and two B777-200ER aircraft during the year; (ii) the full year’s impact of sale and leaseback of one B747-

400 and one B777-300 aircraft last year; and (iii) higher lease rentals for three B747-400 aircraft as structured under the

lease agreements.

Communication and information technology costs decreased by $3 million due to lower (i) software and equipment

maintenance cost; (ii) data transmission costs; and (iii) hire charges for computer equipment, partially offset by higher

information technology professional and contract fees.

Other costs increased by $43 million. This was largely due to higher foreign exchange hedging and revaluation loss.

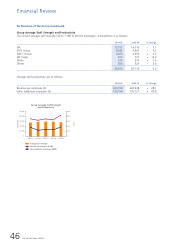

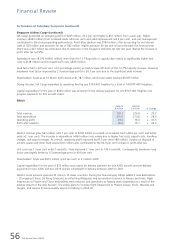

Fuel Productivity and Sensitivity Analysis

Fuel productivity as measured by load tonne-km per American gallon (ltk/AG) decreased by 1.3% over the previous year to

9.35 ltk/AG as a result of changes in network and fleet composition.

A change in fuel productivity (passenger aircraft) of 1.0 per cent would impact the Company’s annual fuel costs by about

$24 million, before accounting for changes in fuel price, USD exchange rate and flying operations.

A change in price of one US cent per American gallon affects the Company’s annual fuel costs by about $19 million, before

accounting for USD exchange rate movements, and changes in volume of fuel consumed.

Fuel Productivity of Passenger Fleet

LTK/AG

LTK/AG

2000-01 2001-02 2002-03 2003-04 2004-05

10.0

9.5

9.0

8.5

8.0

10.0

9.5

9.0

8.5

8.0