Singapore Airlines 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 04/05 91

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

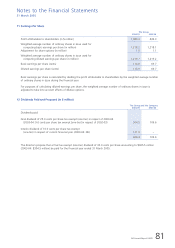

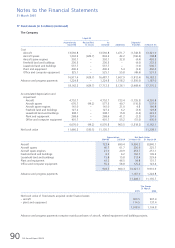

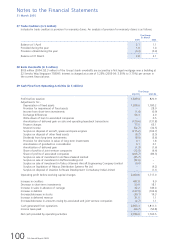

18 Goodwill on Consolidation (in $ million)

The Group

31 March

2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Cost

Balance at 1 April and 31 March 1.5 1.5

–––––––––––––––––––––––––––––––––

Accumulated amortisation

Balance at 1 April 0.1 *

Amortisation charge for the year 0.1 0.1

–––––––––––––––––––––––––––––––––

Balance at 31 March 0.2 0.1

–––––––––––––––––––––––––––––––––

Net carrying amount 1.3 1.4

–––––––––––––––––––––––––––––––––

* Amount less than $0.1 million.

In 2002-03, SATS acquired 66.7% equity interest in Country Foods Pte Ltd at a cost of $6.0 million. Goodwill on

acquisition of $1.5 million was capitalised and amortised over a period of 20 years.

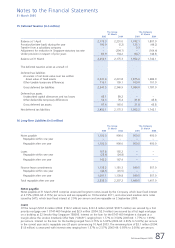

19 Subsidiary Companies (in $ million)

The Company

31 March

2005 2004

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Investment in subsidiary companies (at cost)

Quoted equity investments ## ##

Unquoted equity investments 1,772.4 1,772.4

–––––––––––––––––––––––––––––––––

1,772.4 1,772.4

Impairment loss (16.6) (16.6)

–––––––––––––––––––––––––––––––––

1,755.8 1,755.8

Loans to subsidiary companies 180.0 180.7

–––––––––––––––––––––––––––––––––

1,935.8 1,936.5

–––––––––––––––––––––––––––––––––

Funds from subsidiary companies (758.8) (698.9)

Amounts owing by subsidiary companies 244.3 219.8

Amounts owing to subsidiary companies (207.8) (207.7)

–––––––––––––––––––––––––––––––––

Amounts owing to subsidiary companies, net (722.3) (686.8)

–––––––––––––––––––––––––––––––––

Market value of quoted equity investments 3,854.1 3,279.9

–––––––––––––––––––––––––––––––––

## The value is $2.

In 2003-04, the Company provided $6.8 million impairment loss against the cost of investment in one of its wholly

owned subsidiary company, SIA Properties (Pte) Ltd (“SIAP”). Its business undertaking (which primarily provided intra-

Group services) was transferred to the Company on 1 April 2004. The financial impact of the transfer was not material.

In 2003-04, the Company disposed of its 51% equity interest in Aviation Software Development Consultancy India

Limited for a consideration of $5.3 million (INR140.3 million). The surplus on disposal of the subsidiary company was

reported as exceptional item (refer to note 9 to the financial statements).

Loans to subsidiary companies are unsecured and have repayment terms of up to 10 years. Interest on loans to

subsidiary companies are computed using LIBOR, Singapore Interbank Bid Offer Rate (“SIBOR”) and SGD Swap-Offer

Rates, and applying agreed margins. The interest rates ranged from 0.81% to 3.37% (2003-04: 0.71% to 1.99%) per

annum for SGD loans, and 1.56% to 3.19% (2003-04: 1.47% to 1.76%) per annum for USD loans.

Funds from subsidiary companies are unsecured and have varying repayment terms. Interest on funds from subsidiary

companies are computed using prevailing market rates which ranged from 0.38% to 2.01% (2003-04: 0.25% to

0.90%) per annum for Singapore Dollar funds, from 0.97% to 2.89% (2003-04: 0.93% to 1.40%) per annum for US

Dollar funds, from 2.10% to 2.11% (2003-04: nil) per annum for Euro Dollar funds and from 4.70% to 4.90% (2003-

04: nil) for UK Sterling Pound funds.