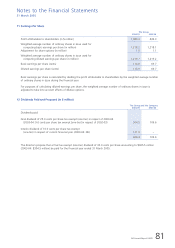

Singapore Airlines 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SIA Annual Report 04/05 79

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

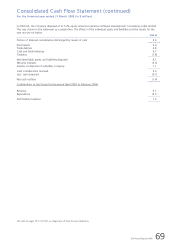

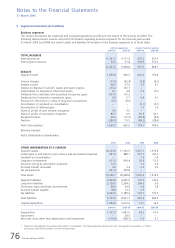

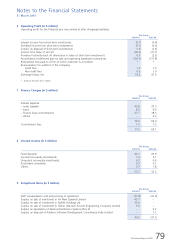

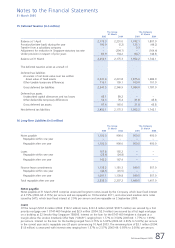

6 Operating Profit (in $ million)

Operating profit for the financial year was arrived at after charging/(crediting):

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interest income from short-term investments (0.7) (0.4)

Dividend income from short-term investments (0.7) (0.5)

Surplus on disposal of short-term investments (1.2) (2.6)

Income from lease of aircraft (49.2) (31.7)

Provision for/(write-back of) diminution in value of short-term investments 0.3 (2.2)

Amortisation of deferred gain on sale and operating leaseback transactions (120.6) (131.8)

Professional fees paid to a firm of which a director is a member * *

Remuneration for auditors of the Company

Audit fees 1.4 1.0

Non-audit fees 0.9 1.0

Exchange losses, net 74.2 41.6

* Amount less than $0.1 million.

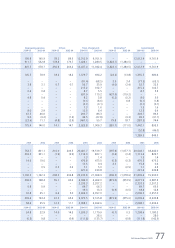

7 Finance Charges (in $ million)

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interest expense:

– notes payable 40.8 37.3

– loans 8.0 8.0

– finance lease commitments 27.7 18.3

– others – 0.3

–––––––––––––––––––––––––––––––––

76.5 63.9

Commitment fees 1.0 1.2

–––––––––––––––––––––––––––––––––

77.5 65.1

–––––––––––––––––––––––––––––––––

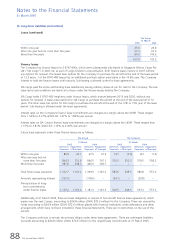

8 Interest Income (in $ million)

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fixed deposits 44.1 24.9

Quoted non-equity investments 7.4 5.1

Unquoted non-equity investments 0.2 0.6

Associated companies 0.3 0.1

Others 0.7 1.8

–––––––––––––––––––––––––––––––––

52.7 32.5

–––––––––––––––––––––––––––––––––

9 Exceptional Items (in $ million)

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Staff compensation and restructuring of operations (37.8) (41.4)

Surplus on sale of investment in Air New Zealand Limited 45.7 –

Surplus on sale of investment in Raffles Holdings Ltd 32.6 –

Surplus on sale of investment in Taikoo (Xiamen) Aircraft Engineering Company Limited 9.0 –

Surplus on liquidation of Abacus Distribution Systems Pte Ltd – 9.2

Surplus on disposal of Aviation Software Development Consultancy India Limited – 1.1

–––––––––––––––––––––––––––––––––

49.5 (31.1)

–––––––––––––––––––––––––––––––––