Singapore Airlines 2005 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 SIA Annual Report 04/05

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

13col

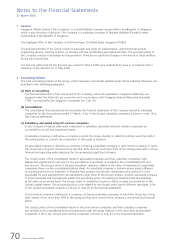

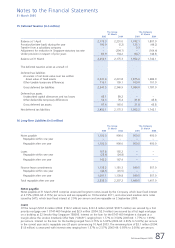

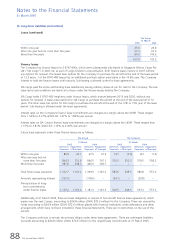

10 Taxation (in $ million)

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Current taxation

Provision for the year 146.6 165.6

Over provision in respect of prior years (85.8) (165.4)

Share of joint venture companies’ taxation:

– provision for the year 0.4 0.3

Share of associated companies’ taxation:

– provision for the year 21.2 12.1

Reversal of tax contingency provision no longer required – (21.2)

–––––––––––––––––––––––––––––––––

82.4 (8.6)

–––––––––––––––––––––––––––––––––

Deferred taxation

Provision/(write-back) for the year 190.9 (5.2)

Under provision in respect of prior years 83.9 134.2

Share of associated companies’ taxation:

– provision for the year 25.8 5.2

– under provision in respect of prior years 4.3 4.7

–––––––––––––––––––––––––––––––––

304.9 138.9

–––––––––––––––––––––––––––––––––

387.3 130.3

Adjustment for reduction in Singapore statutory tax rate – (204.7)

–––––––––––––––––––––––––––––––––

387.3 (74.4)

–––––––––––––––––––––––––––––––––

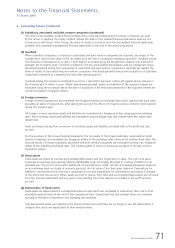

The Group has tax losses of approximately $17.4 million (2004: $17.2 million), unabsorbed capital allowances of

$0.6 million (2004: $0.6 million) and other deductible temporary differences of $3.0 million (2004: $ nil) that are

available for offset against future taxable profits of the companies in which no deferred tax assets are recognised due

to uncertainty of the recoverability. The use of the tax losses and unabsorbed capital allowances are subject to the

agreement of the tax authorities and compliance with certain provisions of the tax legislation of the respective countries

in which the companies operate.

On 27 February 2004, the Government announced a 2% points cut in statutory tax rate from Year of Assessment 2005.

The financial effect of the reduction in tax rate was reflected in 2003-04 accounts. The aggregate adjustment of the

prior year’s deferred tax liabilities was $204.7 million for the Group.

In 2003-04, SIA Engineering Company Limited (“SIAEC”) reversed a tax contingency provision amounting to $21.2

million. The provision was made to cover for potential tax liability that might arise at the time when SIAEC disposed off

certain fixed assets from its Engine Overhaul Division to Eagle Services Asia Private Limited (“ESA”) and the subsequent

divestment of 51% interest in ESA to Pratt & Whitney. Following the closure of this matter in 2003-04, the provision was

no longer required.

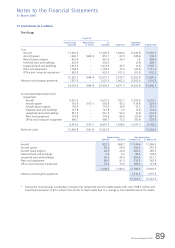

A reconciliation between taxation expense and the product of accounting profit multiplied by the applicable tax rate for

the years ended 31 March is as follows:

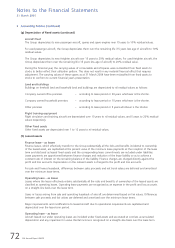

The Group

2004-05 2003-04

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Profit before taxation 1,829.4 820.9

–––––––––––––––––––––––––––––––––

Taxation at statutory tax rate of 20.0% 365.9 164.2

Adjustments

Income not subject to tax (27.8) (13.6)

Expenses not deductible for tax purposes 29.8 27.8

Higher effective tax rates of other countries 18.4 6.2

Under/(over) provision in respect of prior years, net 2.4 (26.5)

Effect of change in statutory tax rate – (204.7)

Reversal of tax contingency provision no longer required – (21.2)

Income under an incentive scheme (4.8) (7.3)

Others 3.4 0.7

–––––––––––––––––––––––––––––––––

Taxation 387.3 (74.4)

–––––––––––––––––––––––––––––––––