Singapore Airlines 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SIA Annual Report 04/05 75

Notes to the Financial Statements

31 March 2005

CC

MOD: CN1323

M Y

C K

While every effort has been taken to carry out instruction to customers satisfaction

NO RESPONSIBILITY liablilty will be accepted for errors

CUSTOMERS ARE THEREFOREURGED TO CHECK THOROUGHLY BEFORE

AUTHORISING PRINTRUNS

DALIM

1 2 3 4 5 6 7 8 9 10 OK TS

CC196777 DLMAC13 10.06.2005 150#

1

3col

2 Accounting Policies (continued)

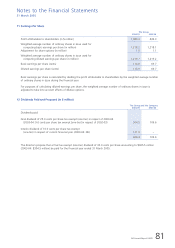

(u) Frequent flyer programme

The Company operates a frequent flyer programme called “KrisFlyer” that provides travel awards to programme

members based on accumulated mileage. A portion of passenger revenue attributable to the award of frequent

flyer benefits, estimated based on expected utilisation of these benefits, is deferred until they are utilised. These

are included under “deferred revenue” on the balance sheet. Any remaining unutilised benefits are recognised as

revenue upon expiry.

(v) Training and development costs

Training and development costs, including start-up program costs, are charged to the profit and loss account in the

financial year in which they are incurred.

(w) Capitalised loan interest

Borrowing costs incurred to finance progress payments for aircraft and building projects are capitalised until the

aircraft are commissioned for operation or the projects are completed. All other borrowing costs are recognised

as expenses in the period in which they are incurred. No (2003-04: $0.1 million) borrowing costs were capitalised

during the year by the Group.

(x) Impairment of assets

The carrying amounts of the Group’s assets are reviewed at each balance sheet date to determine whether there is

any indication of impairment. An impairment loss is recognised whenever the carrying amount of an asset exceeds

its recoverable amount. The impairment loss is charged to the profit and loss account unless it reverses a previous

revaluation credited to equity, in which case it is charged to equity. An impairment loss is reversed if there has been

a change in estimates used to determine the recoverable amount.

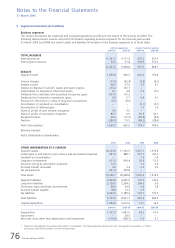

(y) Segmental reporting

Business Segment

The Group’s businesses are organised and managed separately according to the nature of the services provided. The

significant business segments of the Group are airline operations, airport terminal services and engineering services.

Geographical segment

The analysis of revenue by area of original sale from airline operations is derived by allocating revenue to the area in

which the sale was made. Revenue from other operations, which consist principally of airport terminal services and

engineering services, is derived in Singapore and therefore, is not shown.

Assets, which consist principally of flight and ground equipment, support the entire worldwide transportation

system, are mainly located in Singapore. An analysis of assets and capital expenditure of the Group by geographical

distribution has therefore not been included.