Qantas 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

QANTAS ANNUAL REPORT 2014

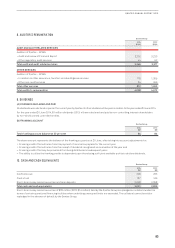

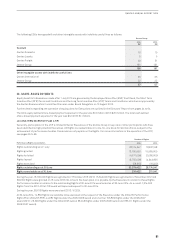

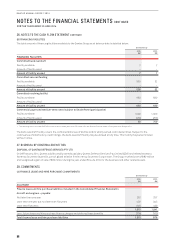

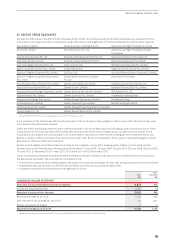

25. DERIVATIVES AND HEDGING INSTRUMENTS

The following section summarises derivative financial instruments in the Consolidated Income Statement, Consolidated Statement

of Comprehensive Income, Consolidated Balance Sheet and the Consolidated Statement of Changes in Equity.

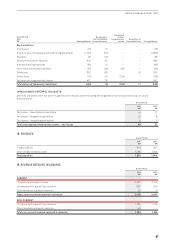

(A) OTHER FINANCIAL ASSETS AND LIABILITIES

Qantas Group

2014

$M

2013

$M

NET OTHER FINANCIAL ASSETS/(LIABILITIES)

Derivatives

Designated as cash flow hedges (98) 48

Designated as fair value hedges (10) (20)

De-designated derivatives (7) 3

Not qualifying for hedge accounting (including time value of options) 73 36

Net other financial assets/(liabilities) (42) 67

Net other financial assets/(liabilities) included in the Consolidated Balance Sheet

Other financial assets – current 172 180

Other financial assets – non-current 34 27

Other financial liabilities – current (182) (86)

Other financial liabilities – non-current (66) (54)

Net other financial assets/(liabilities) (42) 67

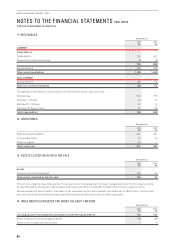

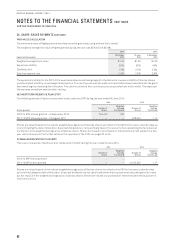

(B) OFFSETTING OTHER FINANCIAL ASSETS AND LIABILITIES

The Group enters into contractual arrangements such as the International Swaps and Derivatives Association (ISDA) Master

Agreement where, upon the occurrence of a credit event (such as default) a termination value is calculated and only a single net

amount is payable in settlement of all transactions that are capable of offset under the contractual terms.

The ISDA agreements do not meet the criteria for offsetting in the Consolidated Balance Sheet. This is because the Group does

not have any current legal enforceable right to offset recognised amounts, because the right to offset is enforceable only on the

occurrence of future events.

The following table sets out the carrying amounts of recognised financial assets and liabilities that are subject to the above agreements.

Qantas Group

$M

2014 2013

Amounts

Presented in the

Consolidated

Balance Sheet

Amounts

Subject

to Netting Net Amount

Amounts

Presented in the

Consolidated

Balance Sheet

Amounts

Subject

to Netting Net Amount

Financial assets

Other financial assets 206 (114) 92 207 (61) 146

Financial liabilities

Other financial liabilities (248) 114 (134) (140) 61 (79)

Total (42) –(42) 67 –67

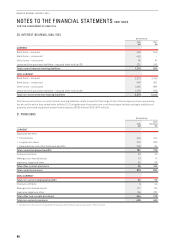

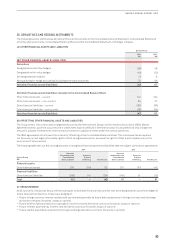

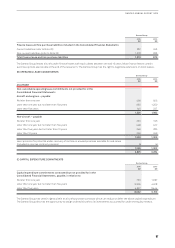

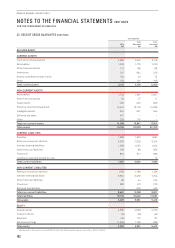

(C) HEDGE RESERVE

At 30 June 2014, the Qantas Group held various types of derivative financial instruments that were designated as cash flow hedges of

future forecast transactions. These were hedging of:

–Future foreign currency revenue receipts and operational payments by future debt repayments in foreign currency and exchange

derivative contracts (forwards, swaps or options)

–Future aviation fuel purchases by crude, gasoil and jet kerosene derivative contracts (forwards, swaps or options)

–Future interest payments by interest rate derivative contracts (forwards, swaps or options)

–Future capital expenditure payments by foreign exchange derivative contracts (forwards or options)