Qantas 2014 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

QANTAS ANNUAL REPORT 2014

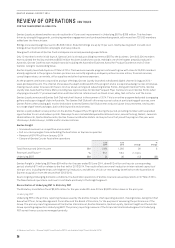

REVIEW OF OPERATIONS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

Material business risks

The aviation industry is subject to a number of inherent risks. These include, but are not limited to, exposure to changes in economic

conditions, changes in government regulations, fuel and foreign exchange volatility and other exogenous events such as aviation

incidents, natural disasters, war or epidemic.

Qantas is subject to a number of specific business risks which may impact the achievement of the Group’s strategy and

financialprospects:

–Competitive intensity: Market capacity growth ahead of demand impacts industry profitability

• Australia’s liberal aviation policy settings coupled with the strength of the Australian economy relative to global economic

weakness has attracted more offshore competitors to the Australian international aviation market, predominantly state-

sponsored airlines. Qantas is responding by building key strategic airline partnerships with strong global partners. Qantas

brings domestic strength and the unrivalled customer offering of Qantas Loyalty. Qantas has also embarked on reducing its

cost base through the Qantas Transformation program. Qantas continues to leverage its considerable fleet flexibility and

established relationships with manufacturers to adjust capital expenditure in line with financial performance and right-size

its fleet and network.

• The Australian domestic aviation market has attracted increased competition in recent years. The resulting intensity of

competition as a result of capacity growth ahead of demand over a sustained period is being mitigated by maintaining the

Qantas Group’s market leading domestic position and executing Qantas Group’s dual-brand strategy. This strategy leverages

Qantas Domestic (including QantasLink) to serve business and premium leisure customers and Jetstar to serve price sensitive

customers. Qantas Domestic is focused on removing the cost base disadvantage to its competitors through its transformation

initiatives and fleet renewal, while Jetstar is working to maintain its low-cost scale advantage and continually lower unit costs.

–Fuel and foreign exchange volatility: The Qantas Group is subject to fuel and foreign exchange risks. These risks are an inherent

part of the operations as an airline. The Qantas Group manages these risks through a comprehensive hedging program.

–Industrial relations: The associated risks of a transformation including industrial action relating to Qantas’ collective agreements

with its employees. This risk is being mitigated through continuous employee engagement initiatives and ongoing, constructive

dialogue with all union groups and other relevant stakeholders.

–Continuity of critical systems: The Group’s operations depend on the continuous functioning of a number of information

technology and communication services. The Group has an extensive control and management framework25 to reduce the

likelihood of outages, ensure early detection and to mitigate the impact.

–Credit rating: Qantas’ credit rating is Ba2 negative outlook and BB+ negative outlook by Moody’s and Standard and Poor’s

respectively. Compared to an investment grade credit rating, the price of new debt funding may increase and/or the Group’s access

to some sources of unsecured credit could reduce over time. To mitigate the risk Qantas maintains strong liquidity and has a

flexible fleet plan to enable it to reduce Capital Expenditure to ensure debt remains within an acceptable range.

–Key business partners: The Qantas Group has relationships with a number of key business partners. Any potential exposures

as a result of these partnerships are mitigated through the Group Risk Management Framework25.

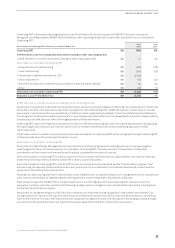

Securing the future with financial discipline

Cash Flow Summary

June

2014

June

2013 Change

%

Change

Operating cash flows $M 1,069 1,417 (348) (25)

Investing cash flows $M (1,069) (1,045) (24) (2)

Net free cash flow26 $M –372 (372) (100)

Financing cash flows $M 173 (953) 1,126 >(100)

Cash at beginning of period $M 2,829 3,398 (569) (17)

Effect of foreign exchange on cash $M (1) 12 (13) >(100)

Cash at period end $M 3,001 2,829 172 6

25 An overview of the Group Risk Management Framework is available through the Qantas Group Business Practices Document on qantas.com.au.

26 Net free cash flow – Operating cash flows less investing cash flows. Net free cash flow is a measure of the amount of operating cash flows that are available (i.e. after investing activities)

to fund reductions in net debt or payments to shareholders.