Qantas 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

QANTAS ANNUAL REPORT 2014

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

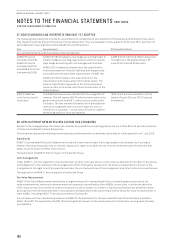

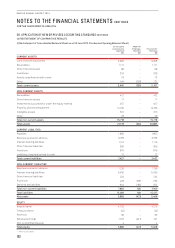

38. APPLICATION OF NEW OR REVISED ACCOUNTING STANDARDS CONTINUED

(iii) Restatement of Consolidated Income Statement (Condensed) for the year ended 30 June 2013

30 June 2013

(as previously

reported)1

$M

A ASB 119

Employee

Benefits

$M

30 June 2013

Restated

$M

Revenue and other income 15,902 –15,902

Expenditure

Manpower and staff related 3,840 63,846

Other 11,858 –11,858

Statutory profit before income tax expense and net finance costs 204 (6) 198

Net finance costs (187) –(187)

Statutory profit before income tax expense 17 (6) 11

Income tax expense (11) 2(9)

Statutory profit after income tax expense 6(4) 2

1 Refer to Note 36(W).

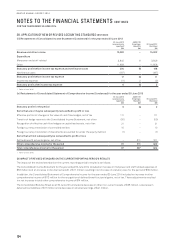

(iv) Restatement of Consolidated Statement of Comprehensive Income (Condensed) for the year ended 30 June 2013

30 June 2013

(as previously

reported)1

$M

A ASB 119

Employee

Benefits

$M

30 June 2013

Restated

$M

Statutory profit for the period 6(4) 2

Items that are or may be subsequently reclassified to profit or loss

Effective portion of changes in fair value of cash flow hedges, net of tax 111 –111

Transfer of hedge reserve to the Consolidated Income Statement, net of tax (50) –(50)

Recognition of effective cash flow hedges on capitalised assets, net of tax 21 –21

Foreign currency translation of controlled entities 10 –10

Foreign currency translation of investments accounted for under the equity method (1) –(1)

Items that will not subsequently be reclassified to profit or loss

Defined benefit actuarial gains, net of tax –311 311

Other comprehensive income for the period 91 311 402

Total comprehensive income for the period 97 307 404

1 Refer to Note 36(W).

(B) IMPACT OF REVISED STANDARD ON THE CURRENT REPORTING PERIOD’S RESULTS

The impact of the revised standard on the current reporting period’s results is as follows:

The Consolidated Income Statement for the year ended 30 June 2014 included an increase in manpower and staff related expenses of

$56million and an increase in income tax benefit of $17million resulting in an increase in statutory loss for the period of $39million.

In addition, the Consolidated Statement of Comprehensive Income for the year ended 30 June 2014 included an increase in other

comprehensive income of $113million for the recognition of defined benefit actuarial gains, net of tax. These adjustments resulted

ina net increase in total other comprehensive income of $74million.

The Consolidated Balance Sheet as at 30 June 2014 included a decrease in other non-current assets of $58million, a decrease in

deferred tax liabilities of $17million and a decrease in retained earnings of $41million.