Qantas 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

QANTAS ANNUAL REPORT 2014

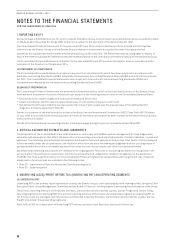

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

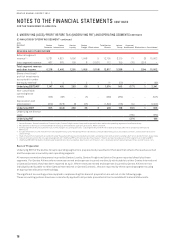

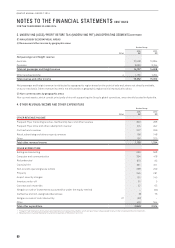

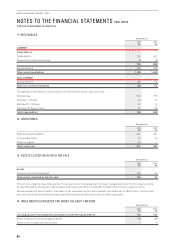

3. UNDERLYING (LOSS)/PROFIT BEFORE TAX (UNDERLYING PBT) AND OPERATING SEGMENTS CONTINUED

(C) ANALYSIS BY OPERATING SEGMENT1 continued

2013

Restated2

$M

Qantas

Domestic

Qantas

International

Qantas

Loyalty

Qantas

Freight Eliminations

Total Qantas

Brands

Jetstar

Group

Corporate/

Unallocated

6

Eliminations

Consolidated

REVENUE AND OTHER INCOME

External segment

revenue3,4 5,731 4,821 1,096 1,048 912,705 3,129 71 (3) 15,902

Inter-segment revenue 487 675 109 8(1,167) 112 159 (70) (201) –

Total segment revenue

and other income 6,218 5,496 1,205 1,056 (1,158) 12,817 3,288 1(204) 15,902

Share of net (loss)/

profit of investments

accounted for under

the equity method55 4 – 2 – 11 (50) – – (39)

Underlying EBITDAR7 1,147 495 263 66 31,974 543 (177) 12,341

Non-cancellable

operating lease

rentals (163) (68) –(5) –(236) (289) – – (525)

Depreciation and

amortisation (619) (673) (3) (25) –(1,320) (116) (14) –(1,450)

Underlying EBIT 365 (246) 260 36 3418 138 (191) 1366

Underlying net finance

costs (180) (180)

Underlying PBT (371) 186

1 Qantas Domestic, Qantas International, Qantas Loyalty, Qantas Freight, Jetstar Group and Corporate/Unallocated are the operating segments of the Qantas Group.

2 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer to Note 38.

3 External segment revenue includes the impact of the change in accounting estimates – passenger revenue of $134million (Qantas Domestic $80million and Qantas International

$54million).

4 Includes settlement income of $125million following the restructure of the Boeing 787 aircraft delivery schedule (reported equally across Qantas Domestic, Qantas International and

Jetstar Group).

5 Share of net profit of investments accounted for under the equity method as reported by Qantas Domestic and Qantas International, before rounding is $4.5million and $4.5million, respectively.

6 Corporate/Unallocated is the only operating segment with Underlying PBT as the primary reporting measure. The primary reporting measure of other segments is Underlying EBIT.

7 Underlying EBITDAR represents Underlying earnings before income tax expense, depreciation, amortisation, non-cancellable aircraft operating lease rentals and net finance costs.

Basis of Preparation

Underlying EBIT of the Qantas Group’s operating segments is prepared and presented on the basis that reflects the revenue earned

and the expenses incurred by each operating segment.

All revenues earned and expenses incurred by Qantas Loyalty, Qantas Freight and Jetstar Group are reported directly by these

segments. For Qantas Airlines where revenues earned and expenses incurred are directly attributable to either Qantas International

or Qantas Domestic they have been reported as such. Where revenues earned and expenses incurred by Qantas Airlines are not

individually attributable to either Qantas International or Qantas Domestic, they are reported by these operating segments using

an appropriate allocation methodology.

The significant accounting policies applied in implementing this basis of preparation are set out on the following page.

Theseaccounting policies have been consistently applied to all periods presented in the Consolidated Financial Statements.