Qantas 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

QANTAS ANNUAL REPORT 2014

INTRODUCTION

OVERVIEW OF THE EXECUTIVE REMUNERATION FRAMEWORK

The objectives of the Executive Remuneration Framework are to attract, motivate, retain and appropriately reward a capable

Executive team. This is achieved by setting pay at an appropriate level and by linking remuneration outcomes to Qantas’

performance. The Qantas Executive Remuneration Framework and the remuneration outcomes for 2013/2014 are summarised

as follows:

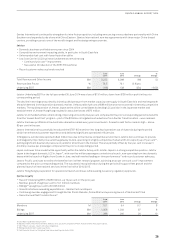

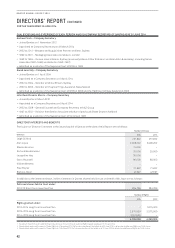

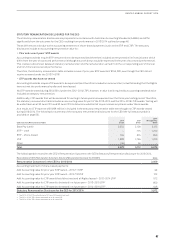

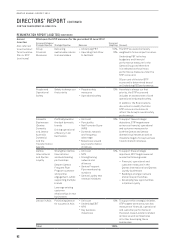

The Executive Remuneration Framework for 2013/2014

Executive Remuneration Component Delivery Performance Measures 2013/2014 Remuneration Outcome

Base Pay

A guaranteed salary level

inclusive of superannuation.

A more detailed description

isprovided on pages 50 to 51.

Cash, superannuation and

other benefits.

An individual’s Base Pay is

fixed/guaranteed element

ofremuneration.

No increases to the Base Pay

ofthe CEO and KMP.

Additionally, the CEO opted to

forego five per cent of his Base

Pay (from 1 January 2014).

Annual Incentive

Referred to as the Short Term

Incentive Plan (STIP).

A more detailed description is

provided on pages 51 to 55.

Two-thirds cash, one-third

shares (with a two year

trading restriction).

Each year Executives

may receive an award

that is a combination of a

cash bonus and an award

of restricted shares if

the Plan’sperformance

conditionsare achieved.

A scorecard of performance

measures.

Underlying PBT is the primary

performance measure (with a

50 per cent weighting).

Other performance measures

are explicitly aligned to the

execution of the Qantas Group

strategy, including delivering

on the transformation agenda.

No awards were made under

the 2013/14 STIP.

Under the default design

of the annual incentive, the

performance against the

non-financial measures

could trigger a partial award.

However for 2013/2014, in

light of the overall financial

performance of the Qantas

Group, the Board used its

discretion to determine that no

annual incentives be awarded.

Long Term Incentive

Referred to as the Long Term

Incentive Plan (LTIP).

The LTIP is described in more

detail on pages 55 to 56.

Rights over Qantas shares.

If performance conditions

over a three year period are

achieved, the Rights vest and

convert to Qantas shares on

aone-for-one basis.

The performance measures

for each of the 2012–2014

LTIP, 2013–2015 LTIP and

2014–2016 LTIP are the relative

Total Shareholder Return

(TSR) performance of Qantas

compared to:

–Companies with ordinary

shares included in the S&P/

ASX 100 (ASX100), and

–An airline peer group (Global

Listed Airlines)

No awards vested.

LTIP awards under the

2012–2014 LTIP were tested

as at 30 June 2014 and the

performance hurdles were

notachieved.

Therefore, 2012–2014 LTIP

Rights did not vest and all

Rights lapsed.

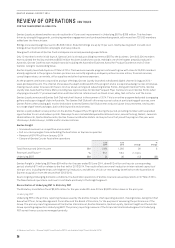

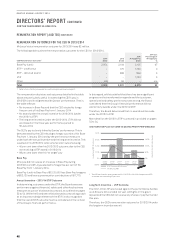

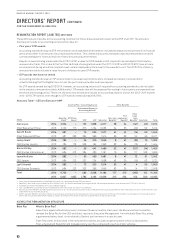

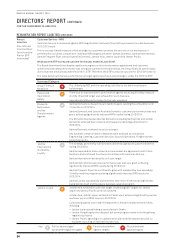

Changes to the Executive Remuneration Framework for 2014/2015

Changes to Pay Mix for 2014/2015

For 2014/2015 only, the pay mix for the CEO and Executive Management will change, with a decrease in weighting towards annual

incentive and an increase in weighting towards long term incentives. In addition, the broader Management population will be invited

to participate in the LTIP for 2014/2015 only (generally, participation in the LTIP is limited to Senior Executives).

This one-off change aligns the entire Management team with the immediate priorities of the transformation agenda, including the

achievement of $2 billion in cost reductions over the next three years.

These changes do not increase the “at target” pay for each manager, as each manager’s LTIP opportunity will be offset by a reduction

in their annual incentive opportunity. For Mr Joyce, this change involves:

–Decreasing his “at target” STIP opportunity for 2014/2015 to 80 per cent of Base Pay (2013/2014: 120 per cent of Base Pay)

–Increasing his “at target” LTIP opportunity for 2014/2015 to 120 per cent of Base Pay (2013/2014: 80 per cent of Base Pay)