Qantas 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

QANTAS ANNUAL REPORT 2014

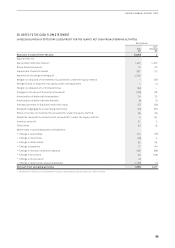

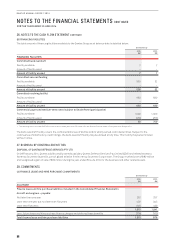

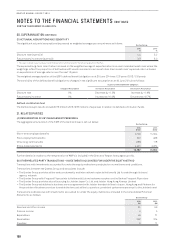

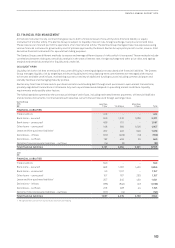

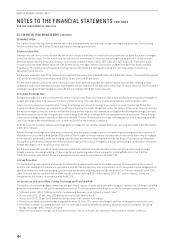

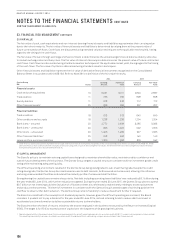

33. FINANCIAL RISK MANAGEMENT

A financial instrument is any contract that gives rise to both a financial asset of one entity and a financial liability or equity

instrument of another entity. The Qantas Group is subject to liquidity, interest rate, foreign exchange, fuel price and credit risks.

These risks are an inherent part of the operations of an international airline. The Qantas Group manages these risk exposures using

various financial instruments, governed by a set of policies approved by the Board. Qantas Group’s policy is not to enter, issue or hold

derivative financial instruments for speculative trading purposes.

The Qantas Group uses different methods to assess and manage different types of risk to which it is exposed. These methods include

correlations between risk types, sensitivity analysis in the case of interest rate, foreign exchange and other price risks, and ageing

analysis and sensitivity analysis for liquidity and credit risk.

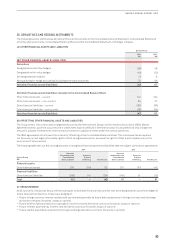

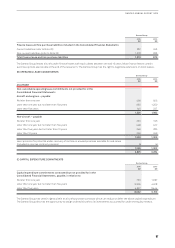

(A) LIQUIDITY RISK

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated with financial liabilities. The Qantas

Group manages liquidity risk by targeting a minimum liquidity level, ensuring long-term commitments are managed with respect

to forecast available cash inflows, maintaining access to a variety of additional funding sources including commercial paper and

standby facilities and managing maturity profiles.

Qantas may from time to time seek to purchase and retire outstanding debt through cash purchases in open market transactions,

privately negotiated transactions or otherwise. Any such repurchases would depend on prevailing market conditions, liquidity

requirements and possibly other factors.

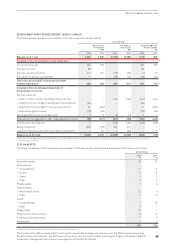

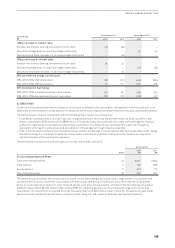

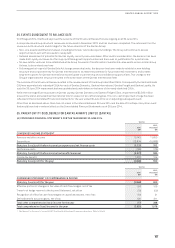

The following tables summarise the contractual timing of cash flows, including estimated interest payments, of financial liabilities

and derivative instruments. Contractual amount assumes current interest rates and foreign exchange rates.

Qantas Group

2014

$M

Less than

1 Year 1 to 5 Years

More than

5 Years Total

FINANCIAL LIABILITIES

Trade creditors 613 – – 613

Bank loans – secured1556 1,616 1,039 3,211

Bank loans – unsecured1486 611 – 1,097

Other loans – unsecured1168 693 1,096 1,957

Lease and hire purchase liabilities1262 402 946 1,610

Derivatives – inflows (122) (409) (19) (550)

Derivatives – outflows 152 459 29 640

Net other financial assets/liabilities – outflows (14) (8) – (22)

Total financial liabilities 2,101 3,364 3,091 8,556

2013

$M

FINANCIAL LIABILITIES

Trade creditors 640 – – 640

Bank loans – secured1663 1,787 1,400 3,850

Bank loans – unsecured150 1,107 –1,157

Other loans – unsecured1107 767 283 1,157

Lease and hire purchase liabilities1257 345 439 1,041

Derivatives – inflows (186) (846) (27) (1,059)

Derivatives – outflows 223 928 44 1,195

Net other financial assets/liabilities – outflows (127) (14) –(141)

Total financial liabilities 1,627 4,074 2,139 7,84 0

1 Recognised financial liability maturity values are shown pre-hedging.