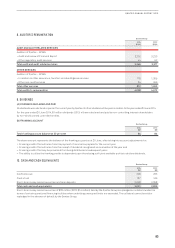

Qantas 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

QANTAS ANNUAL REPORT 2014

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

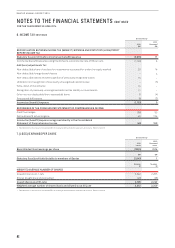

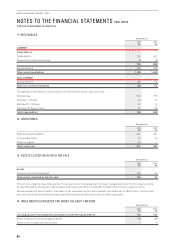

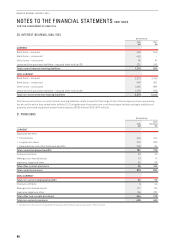

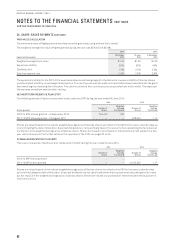

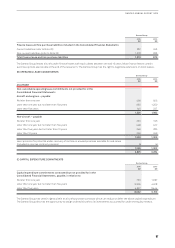

22. CAPITAL AND RESERVES CONTINUED

Foreign Currency Translation Reserve

The foreign currency translation reserve comprises all foreign exchange differences arising from the translation of the financial

statements of foreign controlled entities and associates, as well as from the translation of liabilities that form part of the Qantas

Group’s net investment in a foreign controlled entity.

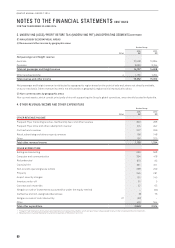

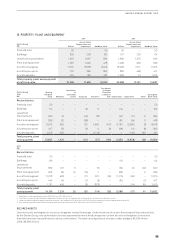

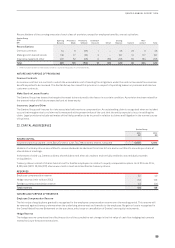

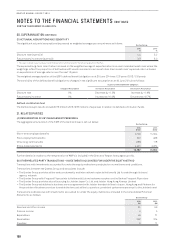

23. IMPAIRMENT OF SPECIFIC ASSETS AND CASH GENERATING UNITS

Impairment of Specific Assets

As part of the Accelerated Qantas Transformation program, the Group has performed a detailed review of its fleet and network

including accelerating the retirement of legacy fleet. This Program has resulted in specific impairments of $328million relating to

property, plant and equipment being classified as held for sale and impaired to their fair value less costs to sell. These impairments

primarily relate to accelerated retirement of the non-reconfigured B747-400, B767-300 and B737-400 fleet and other property, plant

and equipment associated with these fleet types. Impairment of other specific assets (investments and intangible assets) amounted

to $59million.

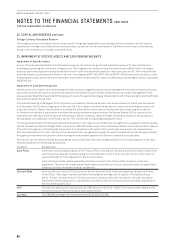

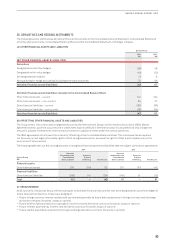

Impairment of Cash Generating Units

Identification of an asset’s Cash Generating Unit (CGU) involves judgement based on how Management monitors the Qantas Group’s

operations and how decisions to acquire and dispose of the Qantas Group’s assets and operations are made. Management have

previously identified the lowest identifiable group of assets that generates largely independent cash inflows being the Qantas Brands

CGU and the Jetstar Group CGU.

At the Board meeting on 28 August 2014, the Group concluded its Structural Review, the commencement of which was announced

on 5 December 2013 and was ongoing as at 30 June 2014. As a result of the Board’s decision to create a new holding structure and

corporate entity for Qantas International to increase the potential for future external investment and create long-term options

for Qantas International to participate in partnership and consolidation opportunities, the Qantas Brands CGU is required to be

separated into individual CGUs for Qantas International, Qantas Domestic, Qantas Freight and Qantas Loyalty for the purpose of

assessing the carrying value of the Group’s assets. This constitutes an adjusting subsequent event.

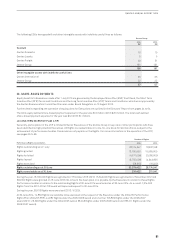

The recoverable amounts of CGUs were determined based on their value in use. While there are significant surpluses in Qantas Loyalty,

Qantas Domestic and Qantas Freight CGUs, impairment of $2,560million arose in the stand-alone Qantas International CGU in respect

of aircraft and engines. In allocating the impairment to individual aircraft assets their recoverable amount was not reduced below

their fair value less costs to sell. The size of the impairment loss recognised is largely the result of wide body aircraft being purchased

through a period where the Australian dollar was significantly weaker against the US dollar compared to recent years.

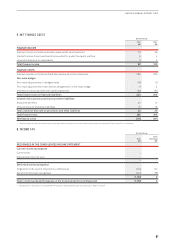

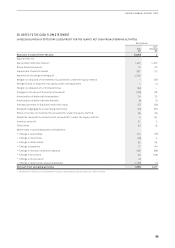

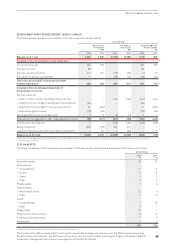

The value in use was determined by discounting the future cash flows forecast to be generated from the continuing use of the units

and were based on the following assumptions:

Assumption How determined

Cash Flows Cash flows were projected based on the Financial Plan covering a three year period. Cash flows to determine

a terminal value were extrapolated using a constant growth rate of 2.5 per cent per annum, which does not

exceed the long-term average growth rate for the industry.

Cash outflows include capital expenditure for the purchase of aircraft and other property, plant and

equipment. These do not include capital expenditure that enhances the current performance of assets and

related cash flows have been treated consistently.

Discount Rate A pre-tax discount rate of 10.5 per cent per annum has been used in discounting the projected cash flows

of the CGUs, reflecting a market estimate of the weighted average cost of capital of the Qantas Group

(2013:10.5per cent per annum). The discount rate is based on the risk-free rate for ten-year Australian

Government Bonds adjusted for a risk premium to reflect both the increased risk of investing in equities and

the risk of the specific CGU.

Fuel The fuel into-plane price is assumed to be US$128 per barrel (2013: US$127) and was set with regard to the

forward fuel curve and commodity analyst expectations.

Currency The US$:A$ exchange rate is assumed to be $0.92 (2013: $0.96).