Qantas 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

QANTAS ANNUAL REPORT 2014

Qantas International continued to strengthen its intra-Asia proposition, including announcing a new codeshare partnership with China

Southern and expanded code share with China Eastern. Qantas International now has agreements with three major China-based

carriers, providing access to one of the world’s largest and fastest growing economies.

Jetstar

–Domestic business profitable every year since 2004

–Competitive environment impacting yields, in particular in South East Asia

–Unfavourable fuel cost with lower Australian dollar

–Low Cost Carrier (LCC) business fundamentals remain strong

• Continued unit cost19 improvement

• Successful introduction of the B787-8 Dreamliner

–Record customer advocacy levels reached

June

2014

June

2013 Change

%

Change

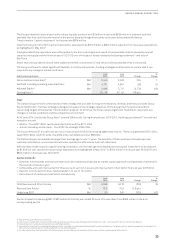

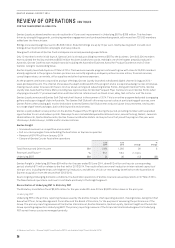

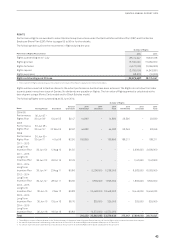

Total Revenue and Other Income $M 3,222 3,288 (66) (2)

Revenue Seat Factor %78.5 79.1 (0.6) pts

Underlying EBIT $M (116) 138 (254) >(100)

Jetstar Underlying EBIT for the full year ended 30 June 2014 was a loss of $116million, down from $138million profit in the prior

corresponding period.

The decline in earnings was primarily driven by yield pressure from market capacity oversupply in South East Asia and market growth

ahead of demand in the Australian domestic market. Unfavourable fuel cost of $86million was not recovered in intensely competitive

markets. The rapid expansion of Jetstar Japan as the airline consolidates its leading LCC position in the Japanese market and

establishment of Jetstar Hong Kong resulted in associate losses of $70million.

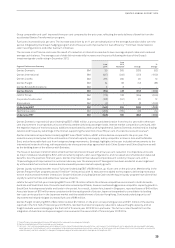

Jetstar’s LCC fundamentals remain strong, improving unit cost by two per cent compared to the prior corresponding period as benefits

from the ‘Lowest Seat Cost’ program – part of the $2 billion in targeted cost reductions from Qantas Transformation – were realised.

Jetstar has been profitable in the Australian domestic market every year since launch. Domestic seat factor remains high – above

80per cent in the year.

Jetstar International successfully introduced the B787-8 Dreamliner into long haul operations out of Australia during the period

which has enhanced customer experience and delivered significant operational efficiencies.

In Singapore, Jetstar Asia reported a $40million loss due to the intense competitive environment. Jetstar Asia continues to provide

a strategically important price sensitive gateway to Asia, operating in a highly competitive market with LCC capacity up 27 per cent35,

putting significant downward pressure on yields for all airlines in the market. This was partially offset by four per cent increase in

Ancillary revenue per passenger compared to the prior corresponding period.

Japan continues to be a substantial opportunity within the Jetstar Group, with Jetstar Japan in a strong competitive position. Jetstar

Japan is the largest domestic LCC in Japan36, with over fivemillion passengers carried since launch, now operating from two domestic

bases with the launch of flights from Osaka in June, and with market leading on-time performance37 and record customer advocacy.

Jetstar Pacific continues to realise the benefits from its fleet renewal program, achieving a two per cent unit cost19 improvement

compared to the prior corresponding period. The successful recapitalisation during the period will support fleet growth and the

planned launch of international services in the first half of 2014/2015.

Jetstar Hong Kong’s preparation for operational launch continues while seeking necessary regulatory approvals.

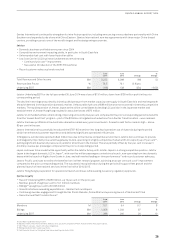

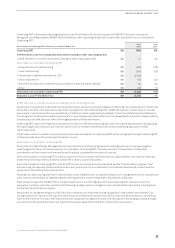

Qantas Loyalty

–Record3 Underlying EBIT of $286million, up 10 per cent on the prior year

–Member growth of eight per cent to 10.1million members

–Billings38 up eight per cent to $1,306million

–Growth initiatives exceeding expectations – Qantas Cash and Aquire

–Continuing member engagement through Qantas Points Website, Online Mall and upcoming launch of Qantas Golf Club

–Record annual Net Promoter Score39

June

2014

June

2013 Change

%

Change

Members M10.1 9.4 0.7 8

Billings $M 1,306 1,209 97 8

Underlying EBIT $M 286 260 26 10

35 Diio Report published 25 June 2014.

36 Based on fleet, network and domestic ASKs as at 10 July 2014 compared to Peach Aviation and Air Asia Japan/Vanilla.

37 MLIT Report January – March 2014 reporting period.

38

Billings represent point sales to partners.

39

Net Promoter Score is at its highest level since reporting started in 2008.