Qantas 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

QANTAS ANNUAL REPORT 2014

(T) NET FINANCE COSTS

Net finance costs comprise interest payable on borrowings calculated using the effective interest method, unwinding of the discount on

provisions and receivables, interest receivable on funds invested, gains and losses on mark-to-market movement in fair value hedges.

Finance income is recognised in the Consolidated Income Statement as it accrues, using the effective interest method.

Finance costs are recognised in the Consolidated Income Statement as incurred, except where interest costs relate to qualifying

assets in which case they are capitalised to the cost of the assets. Qualifying assets are assets that necessarily take a substantial

period of time to be made ready for intended use. Where funds are borrowed generally, borrowing costs are capitalised using the

average interest rate applicable to the Qantas Group’s debt facilities.

(U) INTEREST-BEARING LIABILITIES

Interest-bearing liabilities are recognised initially at fair value less attributable transaction costs. Subsequent to initial recognition,

interest-bearing liabilities are stated at amortised cost, with any difference between cost and redemption value being recognised in

the Consolidated Income Statement over the period of the borrowings on an effective interest basis. Interest-bearing liabilities that

are designated as hedged items are subject to measurement under the hedge accounting requirements.

(V) SHARE CAPITAL

Ordinary Shares

Ordinary shares are classified as equity. Incremental costs directly attributable to issue of ordinary shares are recognised as a

deduction from equity, net of any related income tax benefit.

Repurchase of Share Capital

When share capital recognised as equity is repurchased, the amount of the consideration paid, including directly attributable costs

is recognised as a deduction from equity.

Treasury Shares

Shares held by the Qantas sponsored Employee Share Plan Trust are recognised as treasury shares and deducted from equity.

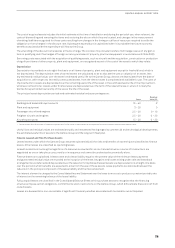

(W) COMPARATIVES

Where applicable, various comparative balances have been reclassified to align with current period presentation. A provision for

long service leave which is expected to be settled beyond the next 12 months is measured as the present value of expected future

payments to be made in respect of services provided by employees up to period end. Notwithstanding this pattern of expected

future

payments, for 30 June 2014, the provision is presented as a current liability in the Consolidated Balance Sheet if the

employees’ entitlements

have vested (i.e. the employee has reached the minimum period of service required to become entitled to

long service leave). For comparability, current provisions for 30 June 2013 have been reclassified on a consistent basis resulting in an

increase incurrent provisions of $277million with a corresponding decrease in non-current provisions (30 June 2012: $309million).