Qantas 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

QANTAS ANNUAL REPORT 2014

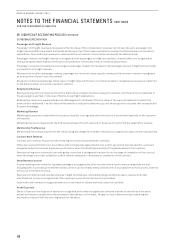

Software

Software is stated at cost less accumulated amortisation and impairment losses. Software development expenditure, including

the cost of materials, direct labour and other direct costs, is only recognised as an asset when the Qantas Group controls future

economic benefits as a result of the costs incurred and it is probable that those future economic benefits will eventuate and the

costs can be measured reliably. Amortisation is charged to the Consolidated Income Statement on a straight-line basis over the

estimated useful life of three to 10 years.

Brand Names and Trademarks

Brand names and trademarks are carried at cost less any accumulated impairment losses. Brand names and trademarks are

allocated to the relevant CGU and are not amortised as they are considered to have an indefinite useful life and are tested annually

for impairment.

Customer Contracts/Relationships

Customer contracts/relationships are carried at their fair value at the date of acquisition less accumulated amortisation and

impairment losses. Amortisation is calculated based on the estimated timing of benefits expected to be received from those assets,

which ranges from five to 10 years.

(O) PAYABLES

Liabilities for trade creditors and other amounts payable are carried at cost.

(P) EMPLOYEE BENEFITS

Wages, Salaries, Annual Leave and Sick Leave

Liabilities for wages, salaries, annual leave (including leave loading) and sick leave vesting to employees are recognised in respect of

employees’ services up to the end of the reporting period. These liabilities are measured at the amounts expected to be paid when

they are settled and include related on-costs, such as workers compensation insurance, superannuation and payroll tax.

Employee Share Plans

The fair value of equity-based entitlements settled in equity instruments is recognised as an employee expense with a corresponding

increase in equity. The fair value is estimated at grant date and recognised over the period during which the employees become

unconditionally entitled to the equity instrument.

The amount recognised as an expense is adjusted to reflect the actual number of entitlements that vest, except where forfeiture is

only due to share prices not achieving the threshold for vesting.

The fair value of equity-based entitlements settled in cash is recognised as an employee expense and a corresponding liability is

recognised over the period that the employees unconditionally become entitled to payment. The liability is remeasured at each

reporting date and at settlement date. Any changes in the fair value of the liability are recognised as an employee expense in the

Consolidated Income Statement.

Long Service Leave

The liability for long service leave is recognised as a provision for employee benefits and measured at the present value of estimated

futu

re payments to be made in respect of services provided by employees up to the end of the reporting period. The provision is

calculated using expected future increases in wage and salary rates including related on-costs and expected settlement dates

based on staff turnover history. The provision is discounted using State Government Bond rates which most closely match the terms

to maturity of the provision. The unwinding of the discount is treated as a finance charge.

Defined Contribution Superannuation Plans

The Qantas Group contributes to employee defined contribution superannuation plans. Contributions to these plans are recognised

as an expense in the Consolidated Income Statement as incurred.

Defined Benefit Superannuation Plans

The Qantas Group’s net obligation with respect to defined benefit superannuation plans is calculated separately for each plan.

The Qantas Superannuation Plan has been split based on the divisions which relate to accumulation members and defined benefit

members. Only defined benefit members are included in the Qantas Group’s net obligation calculations. The calculation estimates

the amount of future benefit that employees have earned in return for their service in the current and prior periods, which is

discounted to determine its present value, and the fair value of any plan assets is deducted.

The discount rate used is the yields at balance sheet date on State Government Bonds which have maturity dates approximating

theterms of Qantas’ obligations. The calculation is performed by a qualified actuary using the projected unit credit method.