Qantas 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

QANTAS ANNUAL REPORT 2014

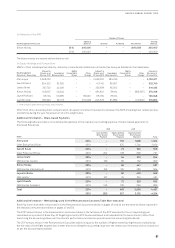

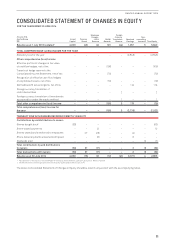

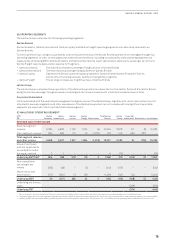

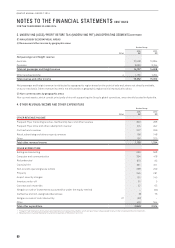

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 30 JUNE 2014

30 June 2014

Qantas Group

$M

Issued

Capital

Treasury

Shares

Employee

Compen-

sation

Reserve

Hedge

Reserve

Foreign

Currency

Translation

Reserve

Retained

Earnings

Non-

controlling

Interests Total Equity

Balance as at 1 July 2013 restated14,693 (43) 49 123 (44) 1,057 55,840

TOTAL COMPREHENSIVE (LOSS)/INCOME FOR THE YEAR

Statutory loss for the year –––––(2,843) –(2,843)

Other comprehensive (loss)/income

Effective portion of changes in fair value

ofcashflow hedges, net of tax –––(106) –––(106)

Transfer of hedge reserve to the

Consolidated Income Statement, net of tax –––(70) –––(70)

Recognition of effective cash flow hedges

on capitalised assets, net of tax –––(19) –––(19)

Defined benefit actuarial gains, net of tax –––––113 –113

Foreign currency translation of

controlledentities – – – – 2 – – 2

Foreign currency translation of investments

accounted for under the equity method – – – – 1 – – 1

Total other comprehensive (loss)/income –––(195) 3113 –(79)

Total comprehensive (loss)/income for

theyear – – – (195) 3(2,730) –(2,922)

TRANSACTIONS WITH OWNERS RECORDED DIRECTLY IN EQUITY

Contributions by and distributions to owners

Shares bought back2(63) ––––––(63)

Share-based payments – – 12 ––––12

Shares vested and transferred to employees –27 (23) – – (4) – –

Share-based payments unvested and lapsed

– – (6) – – 6 – –

Dividends paid ––––––(1) (1)

Total contributions by and distributions

to owners (63) 27 (17) – – 2 (1) (52)

Total transactions with owners (63) 27 (17) – – 2 (1) (52)

Balance as at 30 June 2014 4,630 (16) 32 (72) (41) (1,671) 42,866

1 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer to Note 38.

2 45,415,538 shares were bought back and cancelled during the year ended 30 June 2014.

The above Consolidated Statement of Changes in Equity should be read in conjunction with the accompanying notes.