Qantas 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

QANTAS ANNUAL REPORT 2014

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

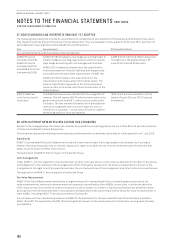

37. NEW STANDARDS AND INTERPRETATIONS NOT YET ADOPTED

The following table details the standards, amendments to standards and interpretations that have been identified as those which

may impact the Qantas Group in the period of initial application. They are available for early adoption at 30 June 2014, but have not

been applied in preparing these Consolidated Financial Statements.

Topic Key requirements Effective date for Qantas

Accounting Standards and Interpretations Not Yet Adopted

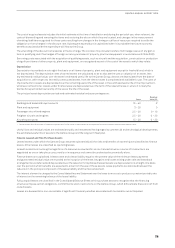

AASB 9

Financial

instruments

(2013),

AASB 9

Financial

Instruments

(2010)

and AASB 9

Financial

Instruments

(2009)

AASB 9 (2013) introduces a new hedge accounting model to

simplify hedge accounting requirements and more closely

align hedge accounting with risk management activities.

AASB 9 (2011) added requirements for the classification

and measurement of financial liabilities that are generally

consistent with the equivalent requirements in AASB 139.

AASB 9 (2010) introduces new requirements for the

classification and measurement of financial assets. The

basis of classification depends on the entity’s business

model and the contractual cash flow characteristics of the

financial asset.

AASB 9 (2013, 2010 and 2009) will become

mandatory for the Qantas Group’s 30

June 2019 Financial Statements.

IFRS 15

Revenue

from Contracts with

Customers

The IASB has issued a new standard for the recognition of

revenue. This will replace IAS 18, which covers contracts for

goods and services and IAS 11, which covers construction

contracts. The new standard is based on the principle that

revenue is recognised when control of a good or service

transfers to a customer – so the notion of control replaces

the existing notion of risks and rewards.

IFRS 15 will become mandatory for the

Qantas Group’s 30 June 2019 Financial

Statements.

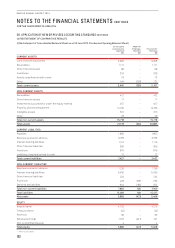

38. APPLICATION OF NEW OR REVISED ACCOUNTING STANDARDS

Except for the changes below, the Group has consistently applied the accounting policies set out in Note 36 to all periods presented

in these Consolidated Financial Statements.

The Group has adopted the following new standards and amendments to standards with a date of initial application of 1 July 2013.

Subsidiaries

AASB 10

Consolidated Financial Statements

introduced a new control model that is applicable to all investees, by focusing on

whether the Group has power over an investee, exposure or rights to variable returns from its involvement with the investee and

ability to use its power to affect those returns.

The application of AASB 10 had no impact on the Qantas Group.

Joint Arrangements

Under AASB 11

Joint Arrangements

, the classification as either joint operations or joint ventures depends on the rights to the assets

and obligations for the liabilities of the arrangements. When making this assessment, the Group considered the structure of the

arrangements, the legal form of any separate vehicles, the contractual terms of the arrangement and other facts and circumstances.

The application of AASB 11 had no impact on the Qantas Group.

Fair Value Measurement

AASB 13

Fair Value Measurement

establishes a single framework for measuring fair value and making disclosures about fair

value measurements, when such measurements are required or permitted by other AASBs. In particular, it unifies the definition

of fair value as the price at which an orderly transaction to sell an asset or to transfer a liability would take place between market

participants at the measurement date. It also replaces and expands the disclosure requirements about fair value measurements in

other AASBs, including AASB 7

Financial Instruments: Disclosures

.

In accordance with the transitional provisions of AASB 13, the disclosures for the year ended 30 June 2014 have been provided in

Notes 13 and 33. The application of AASB 13 had no significant impact on the measurements of the Group’s carrying value of assets

andliabilities.