Qantas 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

QANTAS ANNUAL REPORT 2014

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

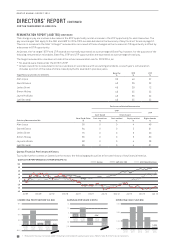

Risk Management

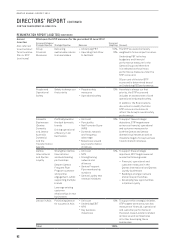

The STIP and the LTIP have design elements that protect against the risk of unintended and unjustified pay outcomes, that is:

–Diversity in their performance measures, which as a suite of measures cannot be directly and imprudently influenced by one

individual employee

–Clear maxima defined for scorecard outcomes under the STIP and a challenging vesting scale under the LTIP

–Diversity in the timeframes in which performance is measured, with performance under the STIP being measured over one year

and performance under the LTIP being measured over three years

–Deferral of a portion of awards under the STIP with a restriction period of up to two years. This creates an alignment with

shareholder interests and also provides a claw-back mechanism, in that the Board may forfeit restricted STIP awards if they were

later found to have been awarded as a result of material financial misstatement

While formal Management shareholding requirements are not imposed, the CEO has a material holding in Qantas shares, currently

valued at around two times Base Pay. The potential equity awards under the STIP and the LTIP will assist Executives in maintaining

shareholdings in Qantas.

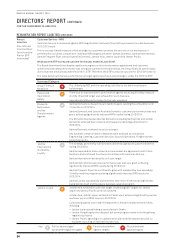

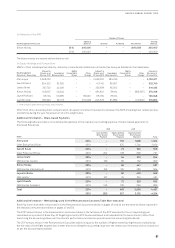

Employee Share Trading Policy

The Qantas Code of Conduct and Ethics contains Qantas’ Employee Share Trading Policy (Policy).

The Policy prohibits employees from dealing in Qantas securities (or securities of other listed entities) while in possession of material

non-public information relevant to the entity.

In addition, nominated employees (including KMP) are:

–Prohibited from dealing in Qantas securities (or the securities of any Qantas Group listed entity) during defined closed periods

–Required to comply with “request to deal” procedures prior to dealing in Qantas securities (or the securities of any Qantas Group

listed entity) outside of defined closed periods

–Prohibited from hedging or entering into any margin lending arrangement, or entering into any other encumbrances over the

securities of Qantas (or the securities of any Qantas Group listed entity) at any time

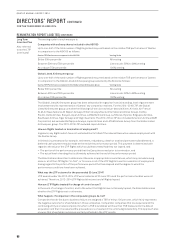

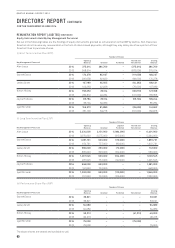

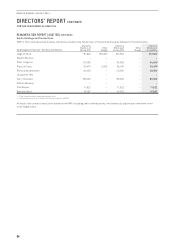

Loans and Other Transactions with Key Management Personnel

No KMP or their related parties held any loans from the Qantas Group during or at the end of the year ended 30 June 2014 or prior year.

A number of KMPs and their related parties have transactions with the Qantas Group. All transactions are conducted on normal

commercial arm’s length terms. The nature of transactions, other than air travel, is set out below:

–Toolangi Vineyards is a related entity to Mr Hounsell. Toolangi Vineyards’ wine has been selected by an independent wine panel

for use on Qantas Business Class services. All transactions were conducted on normal commercial arm’s length terms. The value

of the transactions throughout the year was $25,920 (2013: $7,440). The amount payable as at 30 June 2014 included in Current

Liabilities was nil (2013: nil).

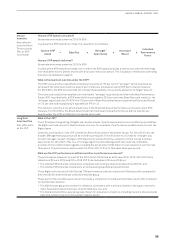

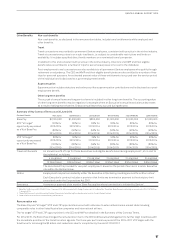

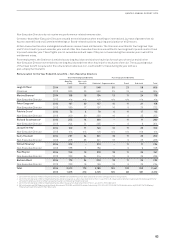

8) NON-EXECUTIVE DIRECTOR FEES

Non-Executive Director fees are determined within an aggregate Non-Executive Directors’ fee pool limit. An annual total fee pool

of $2.75million (excluding industry standard travel entitlements received) was approved by shareholders at the 2013 Annual

General Meeting.

Total Non-Executive Directors’ remuneration (excluding industry standard travel entitlements received) for the year ended

30June2014 was $2.14million (2013: $2.02million), which is within the approved annual fee pool.

Non-Executive Directors’ remuneration reflects the responsibilities of Non-Executive Directors. Fees are benchmarked against

Non-Executive Director fees of S&P/ASX 50 companies.

The Chairman’s fee did not increase during 2013/2014. Other Board fees and Committee fees increased by three per cent from

1July2013. From 1 January 2014, all Directors elected to forego five per cent of both their base fee and Committee fee.

Board Committees1

Chairman2Member Chairman Member

Board Fees3$560,000 $144,000 $58,000 $29,000

1 Committees are the Audit Committee, Remuneration Committee, Nominations Committee and Safety, Health, Environment and Security Committee.

2 The Chairman does not receive any additional fees for serving on or chairing any Board Committee.

3 From 1 January 2014, all Directors elected to forego five per cent of their fees. From 1 January 2014, the Chairman was paid based on an annual fee of $532,000; other Directors were paid

based on an annual fee of $137,000; each Committee Chairman was paid based on an annual fee of $55,000; and each Committee member was paid based on an annual fee of $27,500.

REMUNERATION REPORT (AUDITED) CONTINUED