Qantas 2014 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

QANTAS ANNUAL REPORT 2014

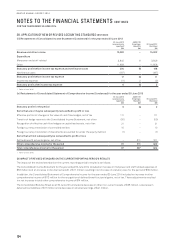

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

36. SIGNIFICANT ACCOUNTING POLICIES CONTINUED

(P) EMPLOYEE BENEFITS continued

The calculation of defined benefit obligations is performed annually by a qualified actuary using the projected unit credit method.

When the calculation results in a potential asset for the Group, the recognised asset is limited to the present value of economic

benefits available in the form of any future refunds from the plan or reductions in future contributions to the plan. To calculate the

present value of economic benefits, consideration is given to any applicable minimum funding requirements.

Remeasurements of the net defined benefit liability, which comprise actuarial gains and losses, the return on plan assets (excluding

interest) and the effect of the asset ceiling (if any, excluding interest), are recognised immediately in other comprehensive income.

The Group determines the net interest expense (income) on the net defined benefit liability (asset) for the period by applying

the discount rate used to measure the defined benefit obligation at the beginning of the annual period to the then-net defined

benefit liability (asset), taking into account any changes in the net defined benefit liability (asset) during the period as a result of

contributions and benefit payments. Net interest expense and other expenses related to defined benefit plans are recognised in

profit or loss.

When the benefits of a plan are changed or when a plan is curtailed, the resulting change in benefit that relates to past service or the

gain or loss on curtailment is recognised immediately in profit or loss. The Group recognises gains and losses on the settlement of a

defined benefit plan when the settlement occurs.

Employee Termination Benefits

Termination benefits are expensed at the earlier of when the Group can no longer withdraw the offer of those benefits and when

the Group recognises costs for a restructuring. If benefits are not expected to be settled wholly within 12 months of the end of the

reporting period, then they are discounted.

(Q) PROVISIONS

A provision is recognised if, as a result of a past event, there is a present legal or constructive obligation that can be measured

reliably, and it is probable that an outflow of economic benefits will be required to settle the obligation.

If the effect is material, a provision is determined by discounting the expected future cash flows required to settle the obligation at a

pre-tax rate that reflects current market assessments of the time value of money and the risks specific to the liability. The unwinding

of the discount is treated as a finance charge.

Dividends

A provision for dividends is recognised in the financial year in which the dividends are declared, for the entire amount, regardless of

the extent to which the dividend will be paid in cash.

Workers Compensation Insurance

The Qantas Group is a licensed self-insurer under the Safety, Rehabilitation and Compensation Act 1988, New South Wales Workers

Compensation Act, the Victorian Accident Compensation Act and the Queensland Workers’ Compensation and Rehabilitation Act.

Qantas has made provision for all notified assessed workers compensation liabilities, together with an estimate of liabilities incurred

but not reported, based on an independent actuarial assessment. The provision is discounted using pre-tax rates that reflect current

market assessments of the time value of money and the risks specific to the liabilities and have maturity dates approximating the

terms of Qantas’ obligations. Workers compensation for all remaining employees is commercially insured.

(R) EARNINGS PER SHARE

Basic earnings per share is determined by dividing the Qantas Group’s net profit attributable to members of the Qantas Group by the

weighted average number of shares on issue during the year.

Diluted earnings per share is calculated after taking into account the number of ordinary shares to be issued for no consideration in

relation to dilutive potential ordinary shares.

(S) CASH AND CASH EQUIVALENTS

Cash and cash equivalents comprise cash at bank and on hand, cash at call and short-term money market securities and term

deposits that are readily convertible to a known amount of cash and are subject to an insignificant risk of change in value.