Qantas 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

QANTAS ANNUAL REPORT 2014

Base Pay

(continued)

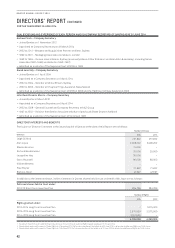

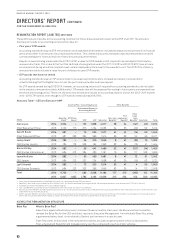

How is Base Pay set?

In performing a Base Pay review, the Board makes reference to external market data including comparable roles

in other listed Australian companies and international airlines. The primary benchmark is a revenue based peer

group of other S&P/ASX companies. The Board believes this is the appropriate benchmark, as it is the comparator

group whose roles best mirror the size, complexity and challenges in managing Qantas’ businesses and is also the

peer group with whom Qantas competes for Executive talent.

Were there any changes to Base Pay for the CEO and KMP during 2013/2014?

A general Management pay freeze was in place during 2013/2014 and therefore there were no increases to the Base

Pay of the CEO and KMP. In addition, the CEO opted to forego five per cent of his Base Pay (from 1 January 2014).

The Base Pay for each Executive KMP is outlined on page 57.

Annual

Incentive

Also referred

to as the Short

Term Incentive

Plan or STIP

What is the STIP?

The STIP is the annual “at risk” incentive plan for members of Qantas Executive Management. Each year these

Executives may receive an award that is a combination of cash and restricted shares to the extent that the plan’s

performance conditions are achieved.

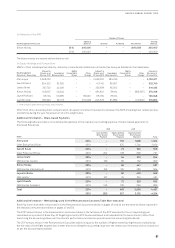

How are the STIP performance conditions chosen and how is performance assessed?

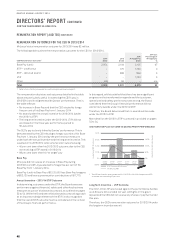

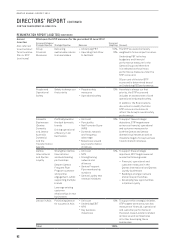

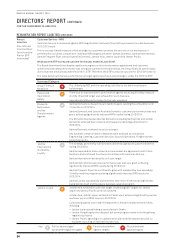

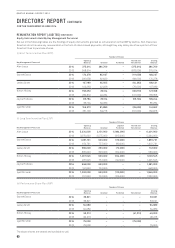

The Board set a “scorecard” of performance conditions for the 2013/14 STIP, explicitly aligning the performance

measures to the Qantas Group strategy. Underlying PBT is the key budgetary and financial performance measure

for the Qantas Group and is therefore the key performance measure in the STIP scorecard.

The Board sets targets for each scorecard measure, and at the end of the year the Board assesses performance

against each scorecard measure and determines the overall STIP scorecard outcome.

A detailed description of the STIP scorecard is provided on pages 52 to 54.

The Board retains discretion over any awards made under the STIP. For example, the Board may decide to adjust

the STIP scorecard outcome where it determines that it does not reflect the performance achieved during the

year. Circumstances may occur where scorecard measures have been achieved or exceeded, but in the view of the

Board it is inappropriate to make a cash award under the STIP. The Board may determine that either no award will

be made, or that any award will be entirely deferred and/or delivered in Qantas shares. On the other hand, there

may be circumstances where performance is below an agreed target, however, the Board determines that it is

appropriate to pay some STIP award.

While the STIP does not have a formal “profit gate”, the Board may also use its discretion to not pay a STIP award

where it believes that the profit result does not warrant an award. In 2013/2014, the Board used its discretion to

not make any awards under the 2013/14 STIP.

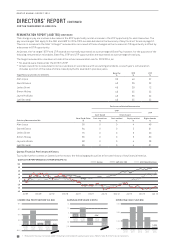

How are STIP awards delivered?

In 2013/2014, no STIP awards were made.

In a year where STIP awards are made, two-thirds of the STIP award would be paid as a cash bonus, with the

remaining one-third deferred into Qantas shares with a two year restriction period.

The Board retains discretion as to how STIP awards are delivered. In each of the 2009/10 STIP, 2010/11 STIP and

2011/12 STIP, the Board exercised this discretion and determined that immediate cash bonuses would not be paid

and instead deferred all awards under the STIP.

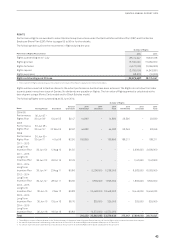

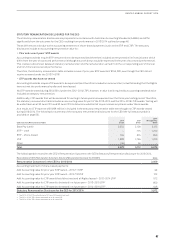

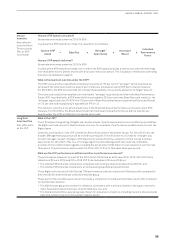

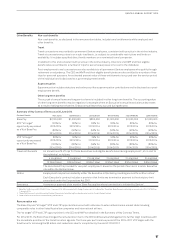

How are STIP awards disclosed in the remuneration tables?

Remuneration Decisions and Outcomes Table

The full value of the STIP awarded for the corresponding year is disclosed in the table on page 49. For 2013/2014,

this value was nil.

Statutory Remuneration Table

Disclosure of STIP awards in the statutory remuneration table on page 50 is more complicated. In the statutory

remuneration table, STIP awards are disclosed as either:

–A “cash incentive” for any cash bonus paid or

–A “share-based payment” for any component awarded either in deferred shares or deferred cash which is

exposed to share price movements during the restriction period

Where “share-based” STIP awards involve deferral over multiple reporting periods, they are reported against each

period in accordance with accounting standards.