Qantas 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

QANTAS ANNUAL REPORT 2014

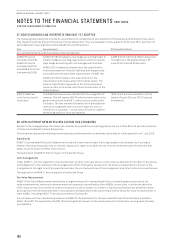

Offsetting of Financial Assets and Financial Liabilities

AASB 2012-2 Amendments to AASB7

Financial Instruments: Disclosures

, requires the Group to expand its disclosures about the

offsetting of financial assets and financial liabilities (see Note 25(B)).

Disclosures of Recoverable Amount for Non-Financial Assets

The Group has early adopted the 2013-3 Amendments to AASB 136

Impairment of Assets

. As a result, the Group has expanded its

disclosures of recoverable amounts when they are based on fair value less costs to sell and an impairment is recognised (see Note 23).

Post-Employment Defined Benefit Superannuation Plans

As a result of the mandatory application of AASB 119

Employee Benefits

(2011), the Group has changed its accounting policy with

respect to the basis of accounting for defined benefit superannuation plans.

The revised standard eliminated the use of the “corridor approach” and instead mandates immediate recognition of all

remeasurements of a defined benefit liability and defined benefit assets (including actuarial gains or losses) in other comprehensive

income. In addition, it changes the measurement principles for the expected return on planned assets and the basis for determining

the income or expense relating to defined benefits.

The Qantas Group’s previous accounting policy for defined benefit superannuation plans utilised the “corridor approach” to account

for actuarial gains/losses. Under that policy, accumulated actuarial gains/losses were carried off balance sheet unless they

exceeded 10 per cent of the defined benefit assets or obligations, in which case they were recognised through the income statement

over the average life of the plan.

Under the revised AASB 119 (2011), these accumulated actuarial gains or losses are recognised on-balance sheet. Subsequent

actuarial gains or losses are recognised on-balance sheet through other comprehensive income.

Upon application of the amended AASB 119 (2011), the Group has applied the transition provisions in the Standard requiring

retrospective application and as a result the following have been restated:

–Consolidated Balance Sheet as at 30 June 2012 (Condensed Opening Balance Sheet);

–Consolidated Balance Sheet as at 30 June 2013 (Condensed Comparative Balance Sheet);

–Consolidated Income Statement (Condensed) for the 12 months ended 30 June 2013; and

–Consolidated Statement of Comprehensive Income (Condensed) for the 12 months ended 30 June 2013

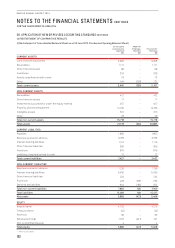

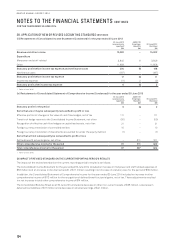

For the restated Comparative Results refer to Note 38(A) – Restatement of Comparative Results

The impact of the revised standard on the Consolidated Income Statement and Consolidated Statement of Comprehensive Income for

the year ended 30 June 2014 has been presented in Note 38(B) – Impact of Revised Standard on the Current Reporting Period’s Results.