Qantas 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

QANTAS ANNUAL REPORT 2014

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

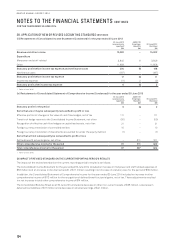

36. SIGNIFICANT ACCOUNTING POLICIES CONTINUED

(I) CONTRACT WORK IN PROGRESS

Contract work in progress represents the gross unbilled amount expected to be collected from customers for contract work

performed to date. It is measured at cost plus profit recognised to date, in accordance with Note 36(D), less an allowance for

foreseeable losses and less progress billings. Cost includes all expenditure related directly to specific projects and an allocation of

fixed and variable overheads incurred in the Qantas Group’s contract activities based on normal operating capacity.

Contract work in progress is presented as part of trade and other receivables in the Consolidated Balance Sheet for all contracts

in which costs incurred plus recognised profits exceed progress billings. If progress billings exceed costs incurred plus recognised

profits, then the difference is presented as revenue received in advance in the Consolidated Balance Sheet.

(J) INVENTORIES

Inventories are measured at the lower of cost and net realisable value. The costs of engineering expendables, consumable stores and

work in progress are assigned to the individual items of inventories on the basis of weighted average costs. Net realisable value is the

estimated selling price in the ordinary course of business.

(K) IMPAIRMENT

Non-financial Assets

The carrying amounts of non-financial assets are reviewed at each balance date to determine whether there is any indication of

impairment. If any such indication exists, the asset’s recoverable amount is estimated. For goodwill and intangible assets with

indefinite lives, recoverable amounts are estimated at the end of each financial year.

The recoverable amount of an asset is the greater of its fair value less costs to sell and its value in use. Assets which primarily

generate cash flows as a group, such as aircraft, are assessed on a cash generating unit (CGU) basis, inclusive of related

infrastructure and intangible assets and compared to net cash inflows for the CGU. Estimated net cash flows used in determining

recoverable amount are discounted to their net present value using a pre-tax discount rate that reflects current market assessments

of the time value of money and the risks specific to the assets.

Identification of an asset’s CGU requires judgement, as it requires identification of the lowest aggregation of assets that generate

largely independent cash inflows. As a result of the outcome of the Structural Review the Group’s identified CGUs has changed for

the year ended 30 June 2014. In Management’s judgement, following the outcome of the Structural Review, the lowest aggregation

of assets, which give rise to CGUs as defined by AASB 136:

Impairment of Assets

are the Qantas Domestic CGU, Qantas International

CGU, Qantas Loyalty CGU, Qantas Freight CGU and the Jetstar Group CGU.

Financial Assets

The carrying value of financial assets is assessed at each reporting date to determine whether there is any objective evidence that it

is impaired. A financial asset is considered to be impaired if objective evidence indicates that one or more events have had a negative

effect on the estimated future cash flows of that asset.

An impairment loss in respect of a financial asset measured at amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows discounted at the asset’s original effective interest rate.

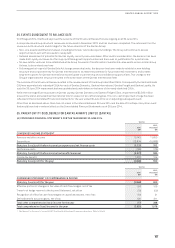

(L) ASSETS CLASSIFIED AS HELD FOR SALE

Non-current assets or disposal groups comprising assets and liabilities that are expected to be recovered primarily through

sale rather than through continued use are classified as held for sale. Immediately before classification as held for sale, the

measurement of the assets or components of a disposal group is remeasured in accordance with the Qantas Group’s accounting

policies. Thereafter, the assets, or disposal group, are measured at the lower of carrying amount and fair value less costs to sell. Any

impairment loss on a disposal group is first allocated to goodwill and then to remaining assets and liabilities on a pro-rata basis,

except that no loss is allocated to inventories, financial assets or deferred tax assets, which continue to be measured in accordance

with the Qantas Group’s accounting policies. Impairment losses on initial classification as held for sale and subsequent gains or

losses on remeasurement are recognised in the Consolidated Income Statement.

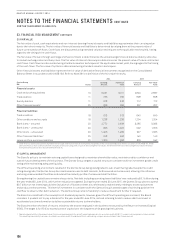

(M) PROPERTY, PLANT AND EQUIPMENT

Owned Assets

Items of property, plant and equipment are stated at cost or deemed cost less accumulated depreciation and impairment losses.

Items of property, plant and equipment are initially recorded at cost, being the fair value of the consideration provided plus incidental

costs directly attributable to the acquisition.