Qantas 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

QANTAS ANNUAL REPORT 2014

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

Long Term

Incentive Plan

Also referred

to as the LTIP

(continued)

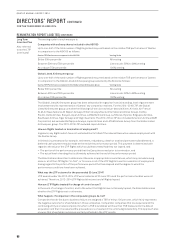

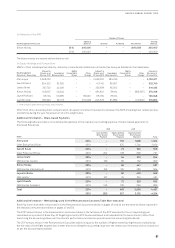

The vesting scale for each measure is:

Companies with ordinary shares included in the ASX100

Up to one-half of the total number of Rights granted may vest based on the relative TSR performance of Qantas

in comparison to the ASX100 as follows:

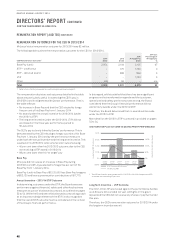

Qantas TSR Performance compared to the ASX100 Vesting Scale

Below 50th percentile Nil vesting

Between 50th and 75th percentile Linear scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

Global Listed Airlines peer group

Up to one-half of the total number of Rights granted may vest based on the relative TSR performance of Qantas

in comparison to the Global Listed Airlines peer group selected by the Board as follows:

Qantas TSR Performance compared to the Global Listed Airline peer group Vesting Scale

Below 50th percentile Nil vesting

Between 50th and 75th percentile Linear scale: 50% to 99% vesting

At or above 75th percentile 100% vesting

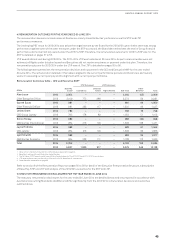

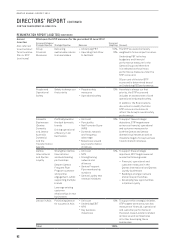

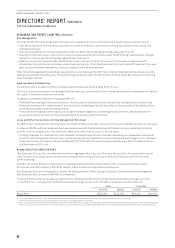

The Global Listed Airlines peer group has been selected with regard to financial standing, level of government

involvement and its representation of Qantas’ key competitor markets. For the 2014–2016 LTIP, the Global

Listed Airlines peer group contains the following full-service and value-based airlines: Air Asia, Air France/

KLM, Air New Zealand, All Nippon Airways, British Airways/Iberia (International Airlines Group), Cathay

Pacific, Delta Airlines, Easyjet, Japan Airlines, LATAM Airlines Group, Lufthansa, Ryanair, Singapore Airlines,

Southwest Airlines, Tiger Airways and Virgin Australia. The 2012–2014 LTIP also included American Airlines (AMR

Corporation) but excluded All Nippon Airways, Japan Airlines and LATAM Airlines Group from the Global Listed

Airlines peer group. The 2013–2015 LTIP excluded Japan Airlines.

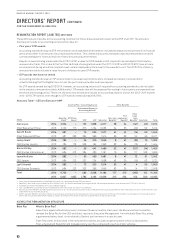

How are Rights treated on termination of employment?

In general, any Rights which have not vested will be forfeited if the relevant Executive ceases employment with

the Qantas Group.

In limited circumstances (for example, retirement, redundancy, death or total and permanent disablement), a

deferred cash payment may be made at the end of the performance period. This payment is determined with

regard to the value of the LTIP Rights which would have vested had they not lapsed, and:

–The portion of the performance period that the Executive served prior to termination, and

–The actual level of vesting that is ultimately achieved at the end of the performance period

The Board retains discretion to determine otherwise in appropriate circumstances, which may include leaving

some or all of the LTIP Rights “on foot”, or for some or all of the LTIP Rights to vest on cessation of employment

having regard to the portion of the performance period that has elapsed and the degree to which the

performance conditions have been achieved.

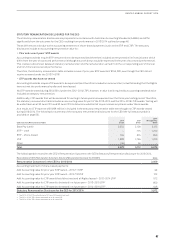

What was the LTIP outcome for the year ended 30 June 2014?

LTIP awards under the 2012–2014 LTIP were tested as at 30 June 2014 and the performance hurdles were not

achieved. Therefore, 2012–2014 LTIP Rights did not vest and all Rights lapsed.

How are LTIP Rights treated if a change of control occurs?

In the event of a change of control, and to the extent that Rights have not already lapsed, the Board determines

whether the LTIP Rights vest or otherwise.

What happens if companies in the comparator groups de-list?

Companies that de-list due to business failure are assigned a TSR of minus 100 per cent, which fairly represents

the negative outcome for shareholders in those companies. Comparator companies that are acquired and the

continuing entity is a listed company (for which a TSR is available) will have their TSR measured to the date of

acquisition and then it is assumed the proceeds are re-invested in the continuing listed entity. This approach also

ensures that shareholder outcomes are fairly reflected in the LTIP results.

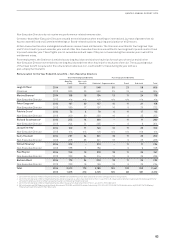

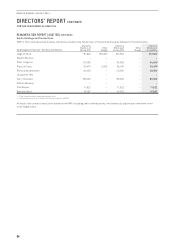

REMUNERATION REPORT (AUDITED) CONTINUED