Qantas 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

QANTAS ANNUAL REPORT 2014

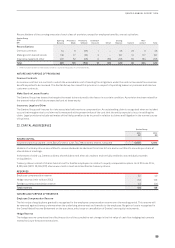

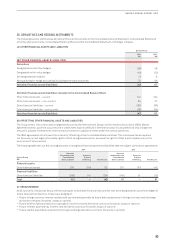

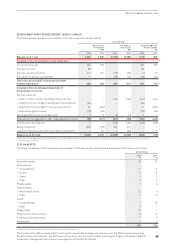

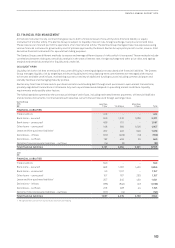

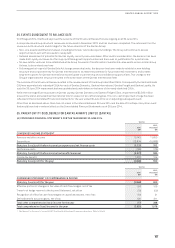

(B) MOVEMENT IN NET DEFINED BENEFIT (ASSET)/LIABILITY

The following table shows a reconciliation of the defined benefit (asset)/liability.

Qantas Group

Present Value

of Obligation

$M

Fair Value of

Plan Assets

$M

Net Defined Benefit

(Asset)/ Liability

$M

2014 2013 2014 2013 2014 2013

Balance as at 1 July 2,223 2,390 (2,339) (2,082) (116) 308

Included in the Consolidated Income Statement

Current service cost 140 159 – – 140 159

Past service cost 361–––36 –

Interest expense/(income) 117 107 (118) (92) (1) 15

Contributions by plan participants – – (23) (25) (23) (25)

Total amount included in manpower and staff

related expenditure 293 266 (141) (117) 152 149

Included in the Consolidated Statement of

Comprehensive Income

Remeasurements:

–Return on plan assets, excluding interest income – – (101) (157) (101) (157)

–(Gain)/loss from change in demographic assumptions (34) –––(34) –

–(Gain)/loss from change in financial assumptions 51 (235) – – 51 (235)

–Experience (gains)/losses (76) (54) – – (76) (54)

Exchange differences on foreign plans 712 (6) (11) 1 1

Total amount recognised in other comprehensive income (52) (277) (107) (168) (159) (445)

Contributions by employer – – (110) (135) (110) (135)

Benefit payments (292) (213) 292 213 – –

Liabilities/(assets) acquired in a business combination –57 –(50) – 7

Balance as at 30 June 2,172 2,223 (2,405) (2,339) (233) (116)

1 Past service cost of $36million for defined benefit curtailment expenses relates to a significant reduction in employees covered by the QSP’s defined benefit plan as a result of

transformation initiatives.

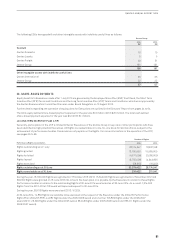

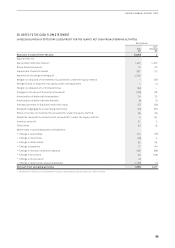

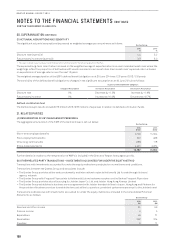

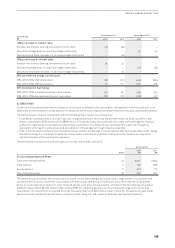

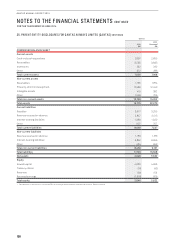

(C) PLAN ASSETS

The major categories of plan assets as a percentage of total plan assets of the Group’s defined benefit plans are as follows:

Qantas Group

2014

%

2013

%

Australian equity118 21

Global equity1

–United States 11 9

–Europe 9 8

–Japan 2 2

–Other 7 7

Private equity 5 4

Fixed interest1

–Government bonds 12 9

–Other 7 9

Credit1

–Corporate debt 710

–Other 2 1

Hedge funds 10 1

Property and infrastructure 9 9

Cash and cash equivalents11 7

Derivatives1– 3

100 100

1 Majority of these plan assets have a quoted market price in an active market.

The Trustee of the QSP is responsible for setting the investment strategy and objectives for the QSP’s assets supporting

the defined benefit liabilities. The QSP does not currently use any asset-liability matching strategies. It utilises traditional

investmentmanagement techniques to manage the defined benefit assets.