Qantas 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

QANTAS ANNUAL REPORT 2014

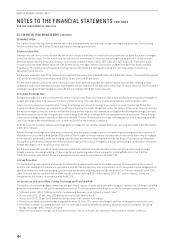

At the inception of the transactions, the Qantas Group documents the relationship between hedging instruments and hedged

items, including the risk management objective and strategy for undertaking each transaction. The Qantas Group also documents

its assessment, both at hedge inception and on an ongoing basis, of whether the hedging instruments that are used in hedge

transactions have been and will continue to be highly effective.

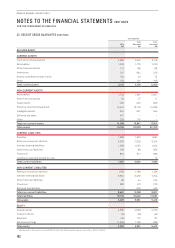

Fair Value Hedges

Changes in the fair value of derivative financial instruments that are designated and qualify as fair value hedges are recorded in the

Consolidated Income Statement, together with any changes in the fair value of the hedged asset or liability that are attributable to

the hedged risk.

Cash Flow Hedges

The effective portion of changes in the fair value of derivative financial instruments that are designated and qualify as cash flow

hedges are recognised in other comprehensive income and are presented within equity in the hedge reserve. The cumulative

gain or loss in the hedge reserve is recognised in the Consolidated Income Statement in the periods when the hedged item will

affect profit or loss (i.e. when the underlying income or expense is recognised). Where the hedged item is of a capital nature, the

cumulative gain or loss recognised in the hedge reserve is transferred to the carrying amount of the asset or liability when the

asset or liability is recognised.

W

hen a hedging instrument expires or is sold, terminated or exercised, or the Qantas Group revokes designation of the hedge

relationship but the hedged forecast transaction is still expected to occur, the cumulative gain or loss at that point remains in

the hedge reserve and is recognised in accordance with the above policy when the transaction occurs. If the underlying hedged

transaction is no longer expected to take place, the cumulative unrealised gain or loss recognised in the hedge reserve with respect

to the hedging instrument is recognised immediately in the Consolidated Income Statement.

Ineffective and Non-designated Derivatives

From time to time certain derivative financial instruments do not qualify for hedge accounting notwithstanding that the derivatives are

held to hedge identified exposures. Any changes in the fair value of a derivative instrument, or part of a derivative instrument, that do

not qualify for hedge accounting are classified as “ineffective” and recognised immediately in the Consolidated Income Statement.

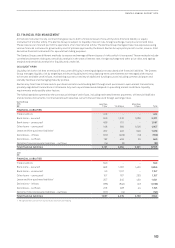

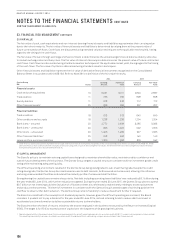

Fair Value Calculations

The fair value of financial instruments traded in active markets is based on quoted market prices at balance date. The fair value of

financial instruments that are not traded in an active market are estimated using valuation techniques consistent with accepted

market practice. The Qantas Group uses a variety of methods and input assumptions that are based on market conditions existing

atbalance date.

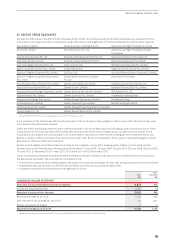

The different methods of estimating the fair value of these items have been defined in the Consolidated Financial Statements as follows:

Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices)

Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs)

Financial Guarantee Contracts

Financial guarantee contracts are recognised as a financial liability at the time the guarantee is issued. The liability is initially

measured at fair value and subsequently at the higher of the amount determined in accordance with AASB 137

Provisions,

Contingent Liabilities and Contingent Assets

and the amount initially recognised less cumulative amortisation, where appropriate.

The fair value of financial guarantees is determined as the present value of the difference in net cash flows between the contractual

payments under the debt instrument and the payments that would be required without the guarantee, or the estimated amount that

would be payable to a third party for assuming the obligations.

Where guarantees in relation to loans or payables of associates and jointly controlled entities are provided for no compensation,

thefair values are accounted for as contributions and recognised as part of the cost of the investment.