Qantas 2014 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

QANTAS ANNUAL REPORT 2014

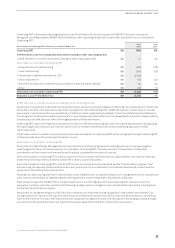

Underlying PBT is derived by adjusting Statutory (Loss)/Profit Before Tax for the impacts of AASB 139

Financial Instruments:

Recognition and Measurement

(AASB 139) that relate to other reporting periods and certain other items which are not included in

Underlying PBT.

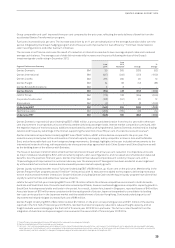

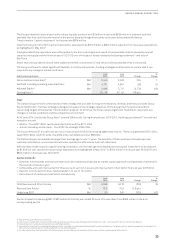

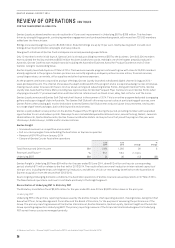

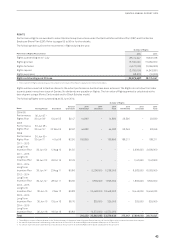

Reconciliation of Underlying PBT to Statutory (Loss)/Profit Before Tax

June

2014

June

2013

Underlying PBT $M (646) 186

Ineffectiveness and non-designated derivatives relating to other reporting periods

- AASB 139 mark-to-market movements relating to other reporting periods $M 72 32

Other items not included in Underlying PBT

– Redundancies and restructuring $M (428) (118)

– Fleet restructuring $M (394) (90)

– Impairment of Qantas International CGU $M (2,560) –

– Other impairment41 $M (59) (22)

– Net profit on disposal of investments accounted for under the equity method $M 62 30

– Other $M (23) (7)

Total items not included in Underlying PBT $M (3,330) (175)

Statutory (Loss)/Profit Before Tax $M (3,976) 11

AASB 139 mark-to-market movements relating to other reporting periods

All derivative transactions undertaken by the Qantas Group represent economic hedges of underlying risk and exposures. The Qantas

Group does not enter into speculative derivative transactions. Notwithstanding this, AASB 139 requires certain mark-to-market

movements in derivatives which are classified as “ineffective” to be recognised immediately in the Consolidated Income Statement.

The recognition of derivative valuation movements in reporting periods which differ from the designated transaction causes volatility

in statutory profit that does not reflect the hedging nature of these derivatives.

Underlying PBT reports all hedge derivative gains and losses in the same reporting period as the underlying transaction by adjusting

the reporting period’s statutory profit for derivative mark-to-market movements that relate to underlying exposures in other

reporting periods.

All derivative mark-to-market movements which have been excluded from Underlying PBT will be recognised through Underlying PBT

in future periods when the underlying transaction occurs.

Other items not included in Underlying PBT

Items which are identified by Management and reported to the chief operating decision-making bodies as not representing the

underlying performance of the business are not included in Underlying PBT. The determination of these items is made after

consideration of their nature and materiality and is applied consistently from period to period.

Items not included in Underlying PBT primarily result from major transformational/restructuring initiatives, transactions involving

investments and impairments of assets outside the ordinary course of business.

Items not included in Underlying PBT in the 2013/2014 year were driven by the accelerated Qantas Transformation program, fleet

restructuring, the disposal of Qantas Defence Services, impairment of an investment in an associate (Helloworld Limited) and the

impairment of the Qantas International CGU.

Redundancy, restructuring and other transformation costs of $428million include the reduction of management and non-operational

roles, further consolidation of engineering and catering facilities and the integration of Australian air Express.

Fleet restructuring costs of $394million include impairment of aircraft, together with associated support property, plant and

equipment, inventory and other related costs following strategic network changes and accelerated fleet retirements resulting from

the Qantas Transformation program.

Impairment of cash generating unit of $2,560million relates to an impairment being recognised in the Qantas International CGU

arising because as a result of the outcome of the Structural Review the Qantas International CGU has been tested as a standalone

CGU for the first time. The size of the impairment loss recognised is largely the result of wide body aircraft being purchased through

aperiod where the Australian dollar was significantly weaker against the US dollar compared to recent years.

41

Includes impairment of investments and other intangible assets.