Qantas 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

QANTAS ANNUAL REPORT 2014

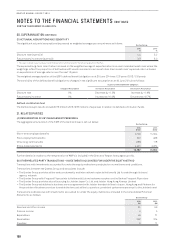

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

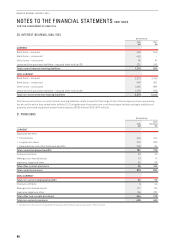

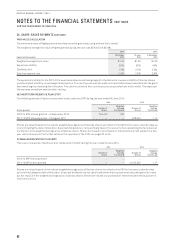

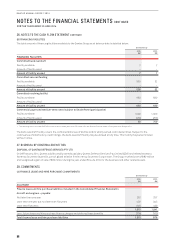

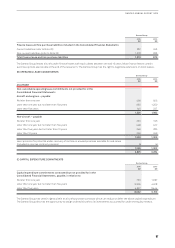

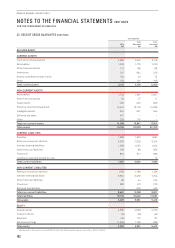

29. CONTINGENT LIABILITIES

Details of contingent liabilities are set out below. The Directors are of the opinion that provisions are not required with respect to

these matters, as it is not probable that a future sacrifice of economic benefits will be required or the amount is not capable of

reliable measurement.

GUARANTEES

Qantas has entered into guarantees in the normal course of business to secure a self-insurance licence under the Safety,

Rehabilitation and Compensation Act 1988, New South Wales Workers Compensation Act, the Victorian Accident Compensation Act

and the Queensland Workers’ Compensation Act and Rehabilitation Act, to support non-aircraft operating lease commitments and

other arrangements entered into with third parties. Due to specific self-insurance provisions raised, the Directors are of the opinion

that the probability of having to make a payment under these guarantees is remote.

AIRCRAFT FINANCING

As part of the financing arrangements for the acquisition of aircraft, the Qantas Group has provided certain guarantees and

indemnities to various lenders and equity participants in leveraged lease transactions. In certain circumstances, including the

insolvency of major international banks and other counterparties that have a minimum credit rating of A-/A3, the Qantas Group may

be required to make payment under these guarantees.

LITIGATION

Freight and Passenger Third Party Class Actions

Qantas is a party to a number of third party class actions relating to its freight and passenger divisions. Qantas continues to have a

number of defences to these class actions. Qantas expects the outcome of these class actions will be known over the course of the

next few years.

Other Claims and Litigation

From time to time, Qantas is subject to claims and litigation during the normal course of business. The Directors have given

consideration to such matters, which are or may be subject to litigation at year end and, subject to specific provisions raised, are of

the opinion that no material contingent liability exists.

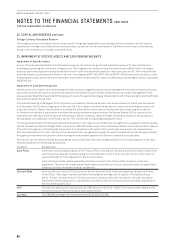

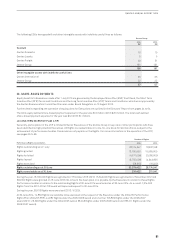

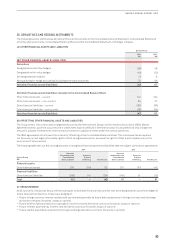

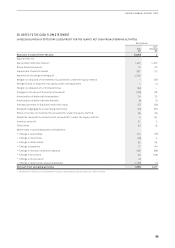

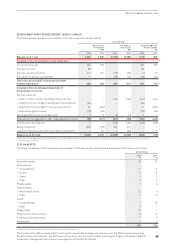

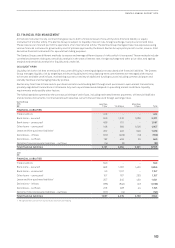

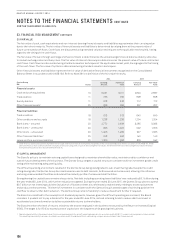

30. SUPERANNUATION

The Qantas Superannuation Plan (QSP) is a hybrid defined benefit/defined contribution fund with multiple divisions which commenced

operation in June 1939. In addition to the QSP, there are a number of small Australian and overseas defined benefit plans.

The Qantas Group makes contributions to defined benefit plans that provide defined benefit amounts for employees upon

retirement. Under the plans, employees are entitled to retirement benefits determined, at least in part, by reference to a formula

based on years of membership and salary levels.

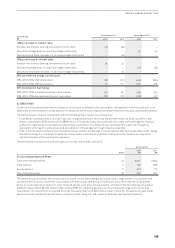

The defined benefit plans are legally separated from the Qantas Group. Responsibility for governance of the plans, including

investment decisions and plan rules, rests solely with the Trustee of the plan. The Trustee of the QSP is a corporate trustee which has

a board comprising five company-appointed directors and five member-elected directors.

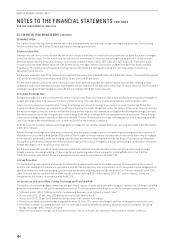

The QSP’s defined benefit plan exposes the Group to a number of risks, the most significant of which are detailed below:

–Investment risk: historically the investment strategy of the QSP’s defined benefit plan was to invest in a significant proportion of

growth assets to match the growth in the plan liabilities. If the plan assets underperform by more than expected, the Group may be

required to provide additional funding to the plan. In April 2013, Qantas and the Trustee of the QSP adopted a plan to progressively

de-risk the defined benefit investment portfolio as the plan’s funding position improves over time.

–Interest rate risk: changes in bond yields, such as a decrease in State Government Bond yields will increase defined benefit

liabilities through the discount rate assumed.

–Inflation risk: the defined benefit liabilities are linked to salary inflation, and higher inflation will lead to higher liabilities.

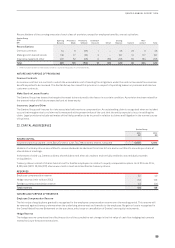

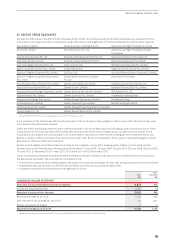

(A) FUNDING

Employer contributions to the defined benefit plans are based on recommendations by the plans’ actuaries. It is estimated that

$98million of normal employer contributions will be paid by the Qantas Group to its defined benefit plans in 2014/2015.

In May 2013, a revised additional funding plan (effective from 1 July 2013), which addresses the requirements of APRA Prudential

Standards, was agreed with the Trustee of the QSP. The determination of Qantas’ additional employer contributions under the

funding plan is triggered where the Defined Benefit Vested Benefits Index (DB VBI) is below 100 per cent. The DB VBI is the ratio of

the QSP’s assets attributable to the defined benefit liabilities to the total defined benefit amount that the QSP would be required to

pay if all members were to voluntarily leave the plan on the funding valuation date. The additional funding plan also triggers further

contributions being made where the amount of any retrenchment benefit paid from the plan is in excess of the funded benefit at the

time of payment. Qantas contributed an additional $8million to the QSP during the year ended 30 June 2014 (2013: $35million).

The QSP’s financial position is monitored by the Trustee each quarter. The actuary recommends the amounts of additional

contributions to be made each quarter, as required under the agreed additional funding plan.