Qantas 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

QANTAS ANNUAL REPORT 2014

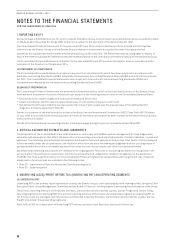

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

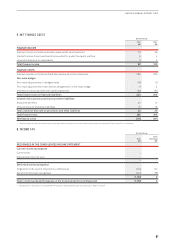

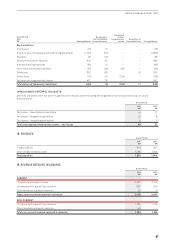

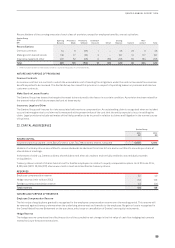

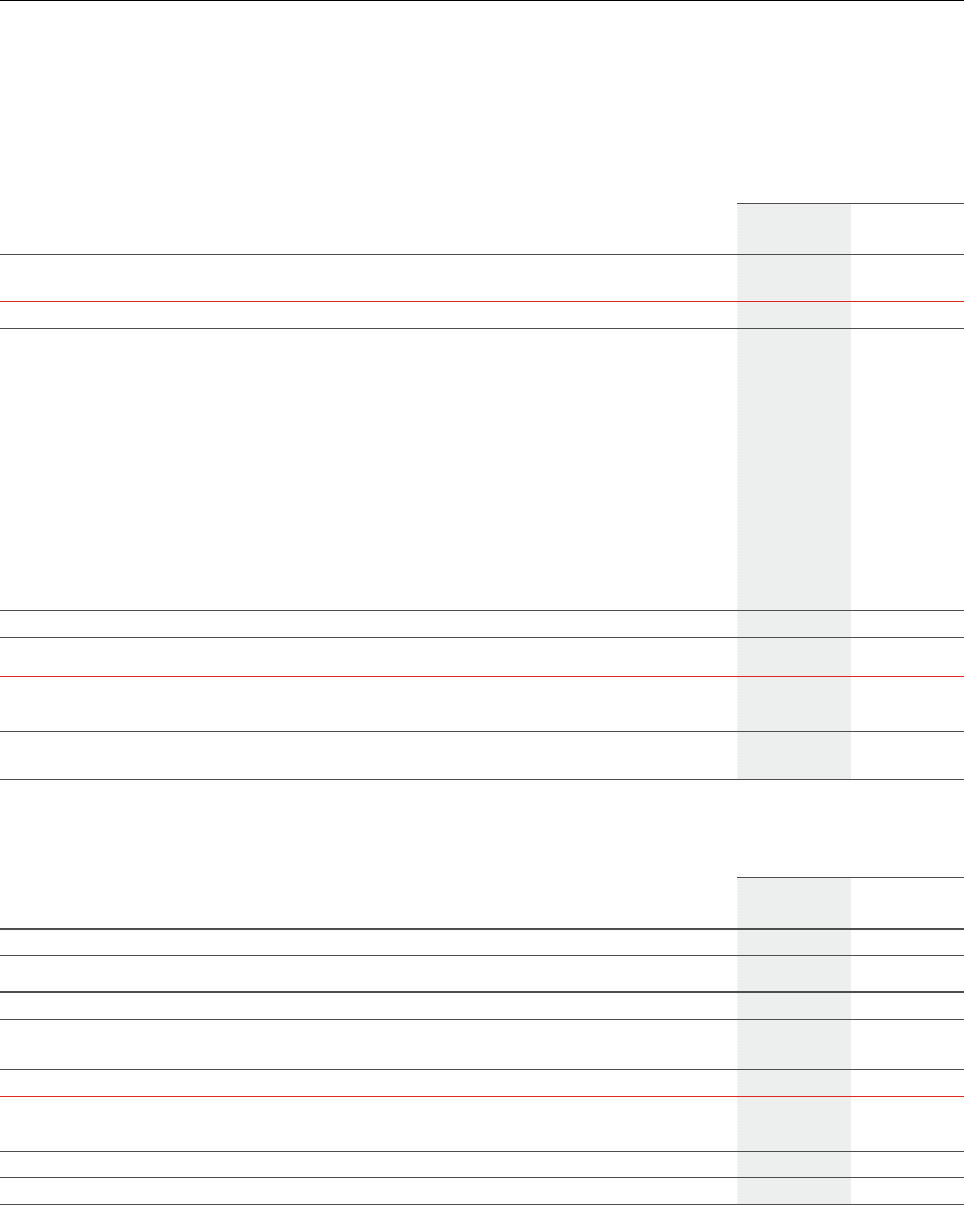

6. INCOME TAX CONTINUED

Qantas Group

2014

$M

2013

Restated1

$M

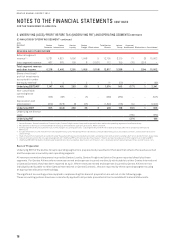

RECONCILIATION BETWEEN INCOME TAX (BENEFIT)/EXPENSE AND STATUTORY (LOSS)/PROFIT

BEFORE INCOME TAX

Statutory (loss)/profit before income tax (benefit)/expense (3,976) 11

Income tax (benefit)/expense using the domestic corporate tax rate of 30 per cent (1,193) 3

Add/(less) adjustments for:

Non-deductible share of net loss for investments accounted for under the equity method 20 14

Non-deductible foreign branch losses – 4

Non-deductible losses and derecognition of previously recognised losses 15 –

Utilisation and recognition of previously unrecognised capital losses –(5)

Write-down of investments 15 –

Recognition of previously unrecognised deferred tax liability on investments 11 –

Other net non-deductible/(non-assessable) items 8(4)

Prior period differences (9) (3)

Income tax (benefit)/expense (1,133) 9

RECOGNISED IN THE CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Cash flow hedges (86) 35

Defined benefit actuarial gains 46 134

Income tax (benefit)/expense recognised directly in the Consolidated

Statement of Comprehensive Income (40) 169

1 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer to Note 38.

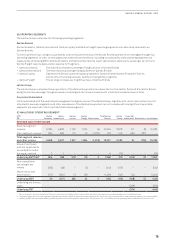

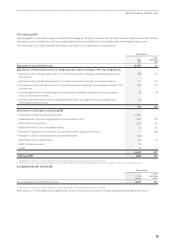

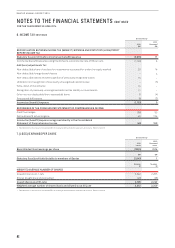

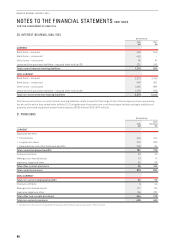

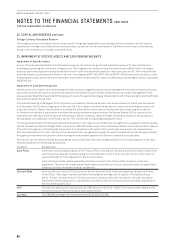

7. (LOSS)/EARNINGS PER SHARE

Qantas Group

2014

cents

2013

Restated1

cents

Basic/diluted (loss)/earnings per share (128.5) 0.04

$M $M

Statutory (loss)/profit attributable to members of Qantas (2,843) 1

Number

M

Number

M

WEIGHTED AVERAGE NUMBER OF SHARES

Issued shares as at 1 July 2,242 2,265

Shares bought back and cancelled (46) (23)

Issued shares as at 30 June 2,196 2,242

Weighted average number of shares (basic and diluted) as at 30 June 2,212 2,249

1 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer to Note 38.