Qantas 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

QANTAS ANNUAL REPORT 2014

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

REMUNERATION REPORT (AUDITED) CONTINUED

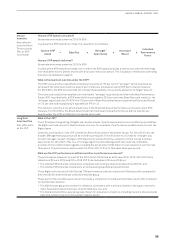

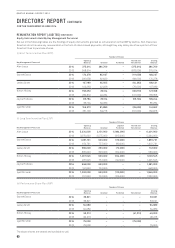

These differences arise due to the accounting treatment of share-based payments (such as the STIP and LTIP). The statutory

disclosures include an accounting remuneration value for:

–Prior years’ STIP awards

Accounting standards require STIP remuneration to be expensed (and therefore included as statutory remuneration) in financial

years which differ from the year of scorecard performance. This creates a disconnect between reported remuneration and the

corresponding years’ financial and non-financial scorecard performance.

Despite no awards being made under the 2013/14 STIP, a value for STIP awards is still required to be included in the statutory

remuneration table. This is due to the fact that deferred shares granted under the 2011/12 STIP and 2012/13 STIP have a future

service period, during which the recipient must remain employed by the Group for the awards to vest. The 2013/2014 statutory

remuneration table includes a value for part of those prior year STIP awards.

–LTIP awards that have not vested

Accounting standards require LTIP remuneration to be expensed (and therefore included as statutory remuneration)

notwithstanding that the Rights have not met the performance hurdles and have lapsed.

No LTIP awards vested during 2013/2014, however, an accounting value is still required by accounting standards to be included

in the statutory remuneration table. Additionally, LTIP awards that will be assessed for vesting in future years are expensed over

the three year testing period. Therefore, the statutory disclosures include an accounting value for part of the 2013–2015 and the

2014–2016 LTIP awards, even though no LTIP awards vested during 2013/2014.

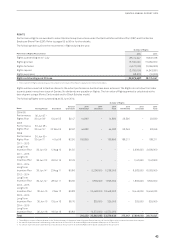

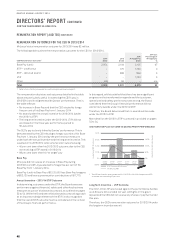

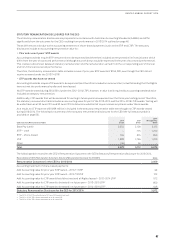

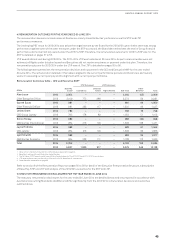

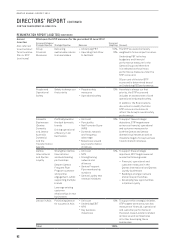

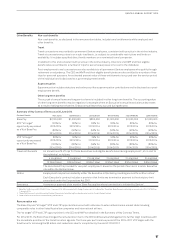

Statutory Table – CEO and Executive KMP

Incentive Plan – Accounting Accrual

Other Benefits

Share-based Payments

Accounting Accrual3

$’000s

Base Pay

(Cash)1,2

STIP Cash

Bonus1STIP LTIP Sub-total

Non-cash

Benefits1,4

Post-

employment

Benefits

5

Other

Long-

term

Benefits6Sub-total Total

Alan Joyce 2014 2,054 – 155 1,808 4,017 38 64 (147) (45) 3,972

Chief Executive Officer 2013 2,109 775 375 1,794 5,053 24 55 (20) 59 5,112

Gareth Evans 2014 981 – 76 520 1,577 41 42 (14) 69 1,646

Chief Financial Officer 2013 981 233 335 366 1,915 36 38 22 96 2,011

Lesley Grant 2014 782 – 54 210 1,046 841 (33) 16 1,062

CEO Qantas Loyalty 2013 785 178 228 162 1,353 33 34 (16) 51 1,404

Simon Hickey 2014 982 – 66 441 1,489 32 41 (107) (34) 1,455

CEO Qantas International 2013 984 213 284 280 1,761 16 35 117 168 1,929

Jayne Hrdlicka 2014 982 – 60 439 1,481 841 12 61 1,542

CEO Jetstar 2013 984 213 237 224 1,658 43 35 (15) 63 1,721

Lyell Strambi 2014 982 – 72 520 1,574 50 41 495 1,669

CEO Qantas Domestic 2013 984 223 323 366 1,896 63 35 14 112 2,008

Total 2014 6,763 – 483 3,938 11,18 4 177 270 (285) 162 11,346

2013 6,827 1,835 1,782 3,192 13,636 215 232 102 549 14,185

1 Short-term employee benefits include Base Pay (cash), non-cash benefits and STIP cash bonus.

2 Base Pay (cash) for Mr Joyce is Base Pay of $2,125,000 (2013: $2,125,000) less Base Pay foregone of $53,125 less superannuation contributions of $17,775 (2013: $16,470).

3 A breakdown of Share-based Payments is provided on page 61.

4 Non-cash Benefits include the value of travel benefits whilst employed and other minor benefits.

5 Post-employment Benefits include superannuation and an accrual for post-employment travel of $46,618 for Mr Joyce and $22,809 for each other Executive (2013: $38,714 for Mr Joyce

and $18,857 for each other Executive).

6 Other Long-term Benefits include movement in annual leave and long service leave balances. The accounting value of other long-term benefits may be negative, for example where an

Executive’s annual leave balance decreases as a result of taking more than the 20 days annual leave they accrued during the year.

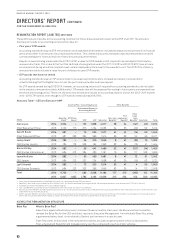

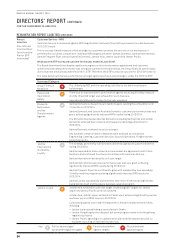

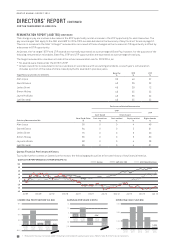

6) EXECUTIVE REMUNERATION STRUCTURE

Base Pay What is Base Pay?

Base Pay is a guaranteed salary level, inclusive of superannuation. Each year, the Remuneration Committee

reviews the Base Pay for the CEO and direct reports to Executive Management. An individual’s Base Pay, being

aguaranteed salary level, is not related to Qantas’ performance in a specific year.

Base Pay (cash), as disclosed in the remuneration tables, excludes superannuation (which is disclosed as

Post-employment Benefits) and includes salary sacrifice components such as motor vehicles.