Qantas 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

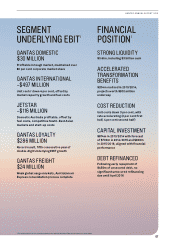

QANTAS DOMESTIC

$30 MILLION

Profitable in tough market, maintained over

80 per cent corporate market share

QANTAS INTERNATIONAL

-$497 MILLION

Unit costs1 down 4 per cent, offset by

market capacity growth and fuel costs

JETSTAR

-$116 MILLION

Domestic Australia profitable, offset by

fuel costs, competitive South-East Asian

markets and start-up costs

QANTAS LOYALTY

$286 MILLION

Record result, fifth consecutive year of

double-digit Underlying EBIT growth

QANTAS FREIGHT

$24 MILLION

Weak global cargo markets, Australian air

Express consolidation process complete

STRONG LIQUIDITY

$3.6bn, including $3 billion cash

ACCELERATED

TRANSFORMATION

BENEFITS

$204m realised in 2013/2014,

projects worth $900 million

underway

COST REDUCTION

Unit costs down 3 per cent, with

rate accelerating (2 per cent first

half, 4 per cent second half)

CAPITAL INVESTMENT

$874m in 2013/2014 with forecast

of $700m in 2014/2015 and $800m

in 2015/2016, aligned with financial

performance

DEBT REFINANCED

Following early repayment of

$450m of unsecured debt, no

significant unsecured refinancing

due until April 2016

SEGMENT

UNDERLYING EBIT1 FINANCIAL

POSITION1

1 For explanations of non-statutory measures, see the Review of Operations section in this report.

07

QANTAS ANNUAL REPORT 2014