Qantas 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

QANTAS ANNUAL REPORT 2014

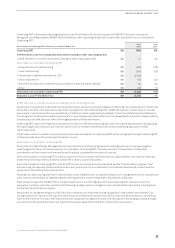

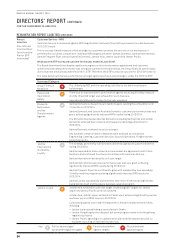

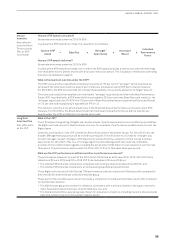

STATUTORY REMUNERATION DISCLOSURES FOR THE CEO

The statutory remuneration disclosures are prepared in accordance with Australian Accounting Standards (AASBs) and differ

significantly from the outcomes for the CEO resulting from performance in 2013/2014 outlined on page 46.

These differences arise due to the accounting treatment of share-based payments (such as the STIP and LTIP). The statutory

disclosures include an accounting remuneration value for:

–Prior and current years’ STIP awards

Accounting standards require STIP remuneration to be expensed (and therefore included as remuneration) in financial years which

differ from the year of scorecard performance (although any cash bonus would be expensed in the year of scorecard performance).

This creates a disconnect between statutory remuneration and the remuneration earned from the corresponding year’s financial

and non-financial scorecard performance.

Therefore, the statutory remuneration table includes a value of prior year STIP awards of $155,228, even though the CEO did not

receive an award under the 2013/14 STIP.

–LTIP awards that have not vested

Accounting standards require LTIP awards to be expensed (and therefore included as remuneration) notwithstanding that the Rights

have not met the performance hurdles and have lapsed.

No LTIP awards vested during 2013/2014 (under the 2012–2014 LTIP), however, a value is still required by accounting standards to be

included as statutory remuneration.

Additionally, LTIP awards that will be assessed for vesting in future years are expensed over the three year testing period. Therefore,

the statutory remuneration table includes an accounting value for part of the 2013–2015 and the 2014–2016 LTIP awards. Testing will

be undertaken as at 30 June 2015 and 30 June 2016 to determine whether Mr Joyce receives any shares under these awards.

As a result, an LTIP expense of $1.808million is included in the statutory remuneration table even though no LTIP awards vested

during 2013/2014. The following is a summary of the statutory remuneration disclosures for the CEO (the full statutory table is

provided on page 50).

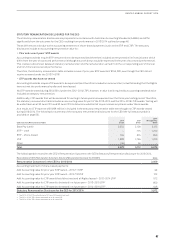

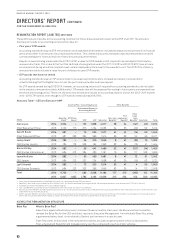

CEO Statutory Remuneration Table

2014

$’000

2013

$’000

2014

At Target Pay

$’000

Base Pay (cash) 2,054 2,109 2,125

STIP – cash –775 1,700

STIP – share-based 155 375 850

LTIP 1,808 1,794 1,700

Other (45) 59 –

Total 3,972 5,112 6,375

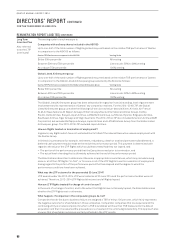

The following table reconciles the CEO’s Remuneration Outcome to the CEO’s Statutory Remuneration disclosure for 2013/2014.

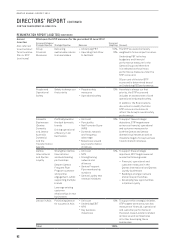

Reconciliation of CEO’s Remuneration Outcome to Statutory Remuneration Disclosure for 2013/2014 $’000

Remuneration Outcomes for the CEO for 2013/2014 2,009

Accounting treatment of share-based payments:

Add: Accounting value for prior year STIP award – 2010/11 STIP 33

Add: Accounting value for prior year STIP award – 2012/13 STIP 122

Add: Accounting value for LTIP award that did not vest and all Rights lapsed – 2012–2014 LTIP1512

Add: Accounting value for LTIP award to be tested in a future year – 2013–2015 LTIP2850

Add: Accounting value for LTIP award to be tested in a future year – 2014–2016 LTIP3446

Statutory Remuneration Disclosure for the CEO for 2013/2014 3,972

1 The 2012–2014 LTIP was tested as at 30 June 2014 and did not vest.

2 The 2013–2015 LTIP is due to be tested as at 30 June 2015.

3 The 2014–2016 LTIP is due to be tested as at 30 June 2016.