Chevron 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

as the unknown magnitude of possible contamination, the

unknown timing and extent of the corrective actions that

may be required, the determination of the company’s liability

in proportion to other responsible parties, and the extent to

which such costs are recoverable from third parties.

Refer to Note 23 below for a discussion of the company’s

Asset Retirement Obligations.

Equity Redetermination For oil and gas producing operations,

ownership agreements may provide for periodic reassess-

ments of equity interests in estimated crude oil and natural

gas reserves. These activities, individually or together, may

result in gains or losses that could be material to earnings in

any given period. One such equity redetermination process

has been under way since 1996 for Chevron’s interests in four

producing zones at the Naval Petroleum Reserve at Elk Hills,

California, for the time when the remaining interests in these

zones were owned by the U.S. Department of Energy. A wide

range remains for a possible net settlement amount for the

four zones. For this range of settlement, Chevron estimates

its maximum possible net before-tax liability at approxi-

mately $200, and the possible maximum net amount that

could be owed to Chevron is estimated at about $150. The

timing of the settlement and the exact amount within this

range of estimates are uncertain.

Other Contingencies Chevron receives claims from and sub-

mits claims to customers; trading partners; U.S. federal, state

and local regulatory bodies; governments; contractors; insur-

ers; and suppliers. The amounts of these claims, individually

and in the aggregate, may be significant and take lengthy

periods to resolve.

The company and its affiliates also continue to review

and analyze their operations and may close, abandon, sell,

exchange, acquire or restructure assets to achieve operational

or strategic benefits and to improve competitiveness and prof-

itability. These activities, individually or together, may result

in gains or losses in future periods.

The company accounts for asset retirement obligations

(ARO) in accordance with Financial Accounting Standards

Board (FASB) Statement No. 143, Accounting for Asset

Retirement Obligations (FAS 143). This accounting standard

applies to the fair value of a liability for an ARO that is

recorded when there is a legal obligation associated with the

retirement of a tangible long-lived asset and the liability can

be reasonably estimated. Obligations associated with the

retirement of these assets require recognition in certain cir-

cumstances: (1) the present value of a liability and offsetting

asset for an ARO, (2) the subsequent accretion of that liability

and depreciation of the asset, and (3) the periodic review of

the ARO liability estimates and discount rates. In 2005, the

FASB issued FASB Interpretation No. 47, Accounting for

Conditional Asset Retirement Obligations – An Interpretation

of FASB Statement No. 143 (FIN 47), which was effective

for the company on December 31, 2005. FIN 47 clarifies

that the phrase “conditional asset retirement obligation,” as

used in FAS 143, refers to a legal obligation to perform asset

retirement activity for which the timing and/or method of

settlement are conditional on a future event that may or

may not be within the control of the company. The obliga-

tion to perform the asset retirement activity is unconditional

even though uncertainty exists about the timing and/or

method of settlement. Uncertainty about the timing and/or

method of settlement of a conditional ARO should be fac-

tored into the measurement of the liability when sufficient

information exists. FAS 143 acknowledges that in some cases,

sufficient information may not be available to reasonably

estimate the fair value of an ARO. FIN 47 also clarifies when

an entity would have sufficient information to reasonably

estimate the fair value of an ARO. In adopting FIN 47, the

company did not recognize any additional liabilities for con-

ditional AROs due to an inability to reasonably estimate the

fair value of those obligations because of their indeterminate

settlement dates.

FAS 143 and FIN 47 primarily affect the company’s

accounting for crude oil and natural gas producing assets.

No significant AROs associated with any legal obligations to

retire refining, marketing and transportation (downstream)

and chemical long-lived assets have been recognized, as inde-

terminate settlement dates for the asset retirements prevent

estimation of the fair value of the associated ARO. The com-

pany performs periodic reviews of its downstream and chemical

long-lived assets for any changes in facts and circumstances

that might require recognition of a retirement obligation.

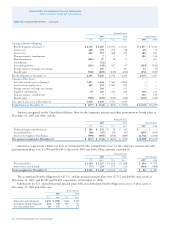

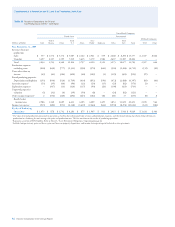

The following table indicates the changes to the com-

pany’s before-tax asset retirement obligations in 2007, 2006

and 2005:

2007 2006 2005

Balance at January 1 $ 5,773 $ 4,304 $ 2,878

Liabilities assumed in the

Unocal acquisition – – 1,216

Liabilities incurred 178 153 90

Liabilities settled (818) (387) (172)

Accretion expense 399 * 275 187

Revisions in estimated cash flows 2,721 1,428 105

Balance at December 31 $ 8,253 $ 5,773 $ 4,304

*

Includes $175 for revision to the ARO liability retained on properties that had

been sold.

In the table above, the amounts for 2007 and 2006

associated with “Revisions in estimated cash flows” reflect

increasing costs to abandon onshore and offshore wells,

Notes to the Consolidated Financial Statements